Free W2 Forms For Small Business

The Internal Revenue Service will need to receive each employees W-2 form. The filing deadline for tax year 2016 is January 31 2017.

Fbi Warns Taxpayers To Beware Of New Scams To Steal W 2 Info Power Of Attorney Form W2 Forms Business Letter Template

Fbi Warns Taxpayers To Beware Of New Scams To Steal W 2 Info Power Of Attorney Form W2 Forms Business Letter Template

If you are an aspiring entrepreneur and are unsure of which tax publications may be relevant to you please consult our Starting a Business section which provides an.

Free w2 forms for small business. Paper Form Printing PDF Printing eFile and Fast Data Import. This form informs the Social. Through this website small businesses and accounting professionals can find and download software to manage payroll report payroll taxes print W2 Forms Print 1099 Forms eFile 1099 electronically file W2 forms print checks and prepare payroll forms like 941 940 944 W-2 W-3 California DE-9 California DE-9C Florida RT-6 Texas C-3 Texas C-4 New York NYS-45 Illinois 941 and Illinois UI-340.

File W-2 Online W-2c Online and View Submission Status and 5. SET OF 25 6 PART KIT - This is the perfect package for up to 25 employees. Federal 0 State 1499.

Choose the right filing method right forms and get everything done on time easily. Permanency of the relationship A 1099 employee will generally have a less-permanent relationship with the employer. W-2 W-3 1099 1096 Purchase tax forms.

You also receive an acknowledgement receipt. Getting started is easy. Just register for Business Services Online.

A W-2 employee has an indefinite relationship with the employer. A copy of the Form W-2 can be filled out by hand in accordance to IRS instructions and submitted by mail. To order official IRS information returns such as Forms W-2 and W-3 which include a scannable Copy A for filing go to IRS Online Ordering for Information Returns and Employer Returns page or visit.

Your employees will use the W-2 form that you provide as they prepare their own personal tax return for the year. Business Services Online and choose Log in 2. If youre wondering how to create W2 forms easily without taking hours and creating headaches read on to learn all the tips and tricks for small businesses.

QUICKBOOKS COMPATIBLE - This kit is QuickBooks compatible and works with common tax form software. Now you can select and download multiple small business and self-employed forms and publications or you can call 800 829-3676 to order forms and publications through the mail. Select Submit or Resubmit Wage.

Youll file this form if youve paid for services performed by an employee if you withheld any amount of income Social Security or Medicare tax from wages if you would have had to withhold income tax if the employee had not claimed exemptions or if you paid more than 600 in wages even if you did not withhold any income Social Security or Medicare tax. On the next screen select Create. The W-2 form is crucial because its how you report the total wages and compensation for the year to both your employee and the IRS.

This is a tax payment form that indicates how much a self-employed individual earned. Try ez1099 Software - Form 1099s 1098s 5498s W2G 1097BTC 8935 3921 3922 1096 Try ezW2Correction Software - Form W-2c and W-3c For Windows. We support Americas small businesses.

January 31st is the filing deadline for BOTH electronic and paper forms W-2. If this date falls on a Saturday Sunday or legal holiday the deadline will be the next business day. Wages to Social Security 4.

Then when tax season arrives youll have to compile all of this information into W-2 forms. Its free fast and secure. Self-Employed Tax Filing Freelancers sole proprietors and contractors file free.

This version does not include PDF import and efile features 3900 per installation. Enter your User ID and password. Let the experts at Discount Tax Forms help you.

For starters filing W-2s electronically is free fast and secure. Type of services provided 1099 employees are often not doing work that is a core service of the employers business. Small Business Owners Prepare and E-file Your Federal Taxes for 0.

EzW2 2019 Small Business Version for Windows To File Year 2019 W2 W3 1099-misc 1096 Tax Forms Unlimited companies unlimited recipients Download version without CD Paper form printing features Note. A W-2 employee does. The good news is the first 10200 that most taxpayers received in unemployment benefits of up to 10200 are not taxable for 2020.

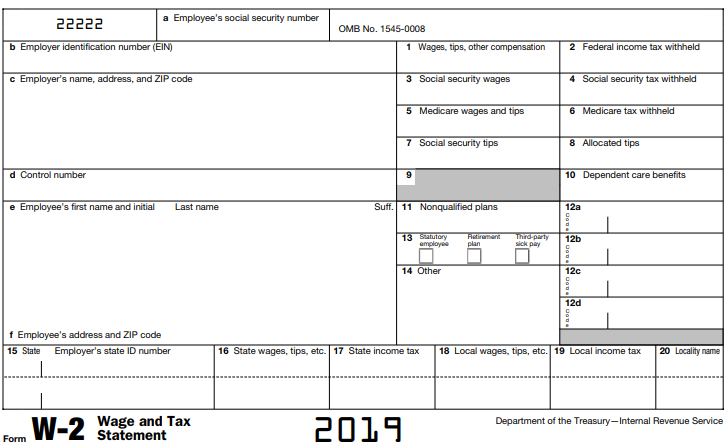

The paper forms are aligned so you can print with ease. Printable IRS W-2 Form for 2019. If youre a small business owner you know you have to file your Form W2 information with Social Security every year.

Companies with over 250 employees are required to file W-2s electronically small business employers can still download and print blank copies of Form W-2 directly from the IRS website. Easy-to-use 1099 W2 Guides help small business alleviate the confusion reduce errors file faster and understand the process better. As a business owner you have to deduct federal and state taxes from your employees incomes throughout the calendar year.

Try ezW2 Software - Form W2 W3 1099-NEC and 1096. On the other hand. The 6-part W-2 tax forms include Federal Copy A Copy B Copy C2 2 Copy D1 2.

You might not have realized you can save time and avoid errors by filing online. Whereas big businesses have specific departments for Human Resources Taxes and Payroll this may all fall in the hands of one person in a small business. From the main Menu select Report.

The SBA connects entrepreneurs with lenders and funding to help them plan start and grow their business. Forms W-2 Online 4 over. What are 1099-K 1099-NEC and 1099-MISC forms.

2020 1099 W-2 Guides for Small Business. Independent contractors will receive an IRS Form 1099-MISC.

2015 W2 Fillable Form Fillable Form 8959 Additional Medicare Tax 2015 Fillable Forms Power Of Attorney Form W2 Forms

2015 W2 Fillable Form Fillable Form 8959 Additional Medicare Tax 2015 Fillable Forms Power Of Attorney Form W2 Forms

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

2015 W2 Fillable Form Fillable Form W 2g Certain Gambling Winnings 2017 Fillable Forms W2 Forms Power Of Attorney Form

2015 W2 Fillable Form Fillable Form W 2g Certain Gambling Winnings 2017 Fillable Forms W2 Forms Power Of Attorney Form

W3 Form 3c 3 Things To Avoid In W3 Form 3c W2 Forms Job Application Form Resignation Letters

W3 Form 3c 3 Things To Avoid In W3 Form 3c W2 Forms Job Application Form Resignation Letters

Pin By Paul Lionetti On Quick Saves In 2021 Internal Revenue Service Tax Forms Fillable Forms

Pin By Paul Lionetti On Quick Saves In 2021 Internal Revenue Service Tax Forms Fillable Forms

Free W2 Template Http Www Valery Novoselsky Org Free W2 Template 2416 Html

Free W2 Template Http Www Valery Novoselsky Org Free W2 Template 2416 Html

2013 W2 Form Microsoft Dynamics Gp 2015 R2 Feature Of The Day W2 W2 Forms Printable Job Applications Microsoft Dynamics

2013 W2 Form Microsoft Dynamics Gp 2015 R2 Feature Of The Day W2 W2 Forms Printable Job Applications Microsoft Dynamics

Fill And Sign W2 Form Online For Free Digisigner

Fill And Sign W2 Form Online For Free Digisigner

Form W2 2013 Fillable How To Fill Out Irs Form W 2 2017 2018 Irs Forms Power Of Attorney Form Tax Forms

Form W2 2013 Fillable How To Fill Out Irs Form W 2 2017 2018 Irs Forms Power Of Attorney Form Tax Forms

W5 Form Look Up 5 Outrageous Ideas For Your W5 Form Look Up W2 Forms Tax Forms Power Of Attorney Form

W5 Form Look Up 5 Outrageous Ideas For Your W5 Form Look Up W2 Forms Tax Forms Power Of Attorney Form

W2 Form Free Download W2 1099 Application Ezw2 Helps Business Prepare Tax W2 Forms Business Downloads Being A Landlord

W2 Form Free Download W2 1099 Application Ezw2 Helps Business Prepare Tax W2 Forms Business Downloads Being A Landlord

Instant W2 Form Generator Create W2 Easily Form Pros

Instant W2 Form Generator Create W2 Easily Form Pros

Ca W3 Form 3 Common Misconceptions About Ca W3 Form Employee Tax Forms Tax Forms Statement Template

Ca W3 Form 3 Common Misconceptions About Ca W3 Form Employee Tax Forms Tax Forms Statement Template

Blank W2 Form 2016 W 2 Laser 3 Up Horizontal Employee Sheet For 2018 Employee Tax Forms Irs Forms Tax Forms

Blank W2 Form 2016 W 2 Laser 3 Up Horizontal Employee Sheet For 2018 Employee Tax Forms Irs Forms Tax Forms

13 Shocking W 2 Template 2014 In 2020 W2 Forms Microsoft Dynamics Power Of Attorney Form

13 Shocking W 2 Template 2014 In 2020 W2 Forms Microsoft Dynamics Power Of Attorney Form

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

W2 Form 2019 W2 Forms Business Template Online Printing

W2 Form 2019 W2 Forms Business Template Online Printing