How To Find A Company's W9 Form

Although it is published by the IRS it is never compiled by the IRS it must be stored in the file of the person requesting it. Limited liability company LLC Partnership.

What Is A W 9 Form How Do I Fill Out A W 9 Gusto

October 2018 Department of the Treasury Internal Revenue Service.

How to find a company's w9 form. Download an IRS Form W-9 from the IRS website. One of the best places to access a W-9 form online is at the following web address. The W-9 form requires the contractor to list his or her name address and taxpayer ID number.

For instructions and the latest information. If not leave it blank. Form W-9 can be printed from the IRS website.

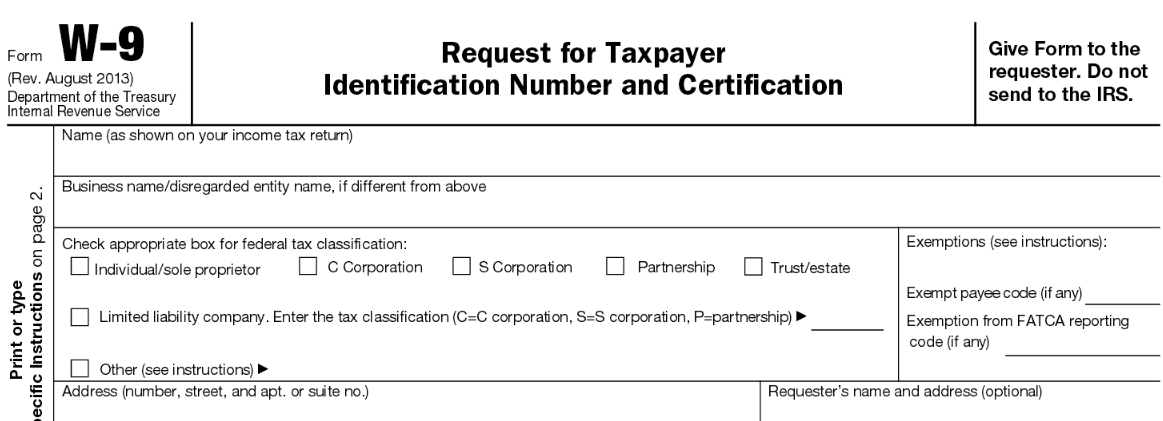

The name on line 1 should never be a disregarded entity a single owner LLC. The insurance company must provide medical care. The first box on the form instructs you to check the appropriate box based on federal tax classification.

Do not send to the IRS. W-9 forms are for self-employed workers like freelancers independent contractors and consultants. Line one of Form W-9 asks for your name.

This is the official Inland Revenue Service website and the copy of the W-9 form is. It could also be the EIN. Check the date in the top left corner of the form as it is updated occasionally by the IRS.

Form W-9 is used to provide a correct TIN to payers or brokers required to file information returns with IRS. Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. The name listed on Form W-9 must match the name listed on the companys articles of incorporation also known as a certificate of incorporation.

The classification options are. Form W-9 is a one-page template that enables businesses to present basic information to an employer so. Section one of the W-9 is where you will need to fill in your name and address.

Request for Taxpayer Identification Number and Certification. Most of the time a company or financial institution will send you a blank W-9 form to complete before you begin business with them. If you visit the IRS website simply do a search for the form w9.

The W9 form is a one-page tax document issued by the IRS to regulate the relationship between employees and their employers. There are many places to access a copy of the W-9 form online. For sole proprietors the taxpayer ID number is often their Social Security number.

You can download and print this form from the IRS website and mail or fax it to the vendor. It is your responsibility as an employee to fill in this form and to submit it back to the IRS together with other documents. W-9 is the regular legal form that is required to collect tax ID data.

Who Has to Fill It Out. If you need to issue the form you can download a W-9 from the IRS website. Form W-9 asks for the independent contractors name business name if different business entity sole proprietorship partnership C corporation S.

The official name of this form is Request for Taxpayer Identification Number TIN and Certification. If you still cannot find the form call the IRS directly. If you are running a sole proprietorship you would enter YOUR name.

For box 2 type or write your businesss name if you have one. If your company operates as an LLC follow these steps for that section of the W-9 form. To clarify this point the name on line 1 must match with the name the IRS associates with your TIN.

You could also set up a system that allows vendors to complete the form electronically. The Form D serves as a brief notice that provides information about the company. And a huge number of companies are requesting this document.

The current revision should read Rev. Communicate the legal name of the S corporation. To get started download the latest W-9 form from the IRS website.

Information about Form W-9 Request for Taxpayer Identification Number TIN and Certification including recent updates related forms and instructions on how to file. Provide the vendor with Form W-9 when you receive an invoice. Give Form to the requester.

You can download the form directly for the official IRS website. For more information see Forms and Associated Taxes for Independent Contractors on the IRS website or contact the IRS at 800-829-3676 for further guidance. How is a W-9 used.

Check the appropriate box to. You need to use it if you have earned over. Lets start by defining a document.

The SEC does not require companies that are raising less than 1 million under Rule 504 of Regulation D to be registered with the SEC but these companies are required to file a Form D with the SEC. For box 1 type or write your full name. However you can complete the form by downloading a PDF copy and manually filling it out for printing.

Complete the basic information in section one.

W 9 Form For Non Profits How To Fill It And Purpose Of The W 9 Form Form Applications In United States Application Gov

How To Fill Out And Sign Your W 9 Form Online

What Is A W 9 Tax Form H R Block

W 9 Form Pa Fill Online Printable Fillable Blank Pdffiller

What Is A Form W9 And How Do I Fill One Out Countless

Can The W 9 Tax Form Be Filled Out Under A Company S Name Or Only Under An Individual S Name Quora

Form W 9 Request For Taxpayer Identification Number And Certificate

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

3 Tips To Get W 9s From Vendors In 2021 The Blueprint

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

2017 Form Irs W 9 Fill Online Printable Fillable Blank Pdffiller

What Is A W 9 Business Attorney Nonprofit Attorney

How To Fill Out Irs Form W 9 2020 2021 Pdf Expert

How To Fill Out A W 9 Form Online Hellosign Blog

How To Complete An Irs W 9 Form Youtube