1099 Form For Companies

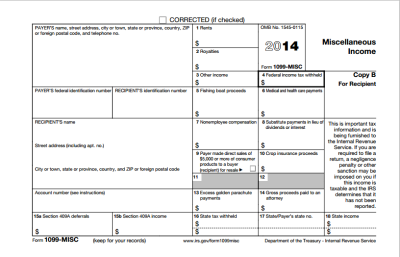

Form 1099-MISC although they may be taxable to the recipient. This form must be issued for health care services provided and for legal services delivered by attorneys.

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Specifically it tracks payments made to an individual or unincorporated business so that their income can be accounted for at the end of each year.

1099 form for companies. The provider of services may be a sole proprietor partnership or even certain corporations subject to the 1099 reporting thresholds and method of payment to the contractor. There is a surprisingly large amount of 1099 forms but the most common is the Form 1099-MISC. Form 1099 is used to report payments to independent contractors instead of the W-2 form used for employee wages.

Information about Form 1099-MISC Miscellaneous Income including recent updates related forms and instructions on how to file. Many of these forms note certain payments to corporations that are reportable on. If youve done any work as a freelancer or independent contractor then you could receive a 1099 form from companies youve worked with most likely a 1099-MISC.

For tax year 2020 and going forward Form 1099-MISC covers only miscellaneous payments. Use Form 1099-MISC to report gross proceeds of 600 or more during the year including payments to corporations Box 10. Businesses will now file Form 1099-NEC for each person in the course of the payors business to whom they paid at least 600 during the year.

For additional information see the 2020 Instructions for Forms 1099-MISC and 1099-NEC. The 1099-MISC form used to include payments made to nonemployees but in 2020 these payments were segregated on their own Form 1099-NEC. This form records income received from brokerage transactions and barter exchanges.

December 12 2017. They are amounts paid in other ways like in a lawsuit settlement agreement for example. As long as the foreign contractor is not a US.

Here are a few common 1099 forms. Information Returns which is similar to a cover letter for your Forms 1099-NEC. The Form 1099-MISC also simply called a 1099 is a tax form that the IRS uses to track miscellaneous income.

The IRS uses this form to keep track of miscellaneous income to taxpayers. Also be aware that there are 20 different 1099 forms. Form 1099-MISC provides information to the IRS that helps it track independent contractor income akin to the way the W-2 supplies information about employees.

Refer to Instructions for Form 1099-MISC PDF PDF General Instructions for Forms 1099 1098 5498 and W-2G PDF PDF and Publication 1220 Specifications for Filing Form 1098 1099. If you had more than 600 worth of debt canceled the creditor will typically file this form with the IRS and. By signing Form W-8BEN the foreign contractor is certifying that he or she is not a US.

Form 1099-K Threshold Lowered From 20000 To 600. Instructions to Form 1099-NEC 1099-MISC. You may see this if you sold.

Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation. You should get a form W-8BEN signed by the foreign contractor. Prior to the update the IRS required the payment settlement entities to report all the payment transactions amounting to at least 20000 in a year with a transaction limit of up to 200 per customer.

If you worked for someone as an independent contractor you should receive a 1099-MISC form from every person who paid you more than 600 over the course of the year. Form 1099-MISC is used to report rents royalties prizes and awards and other fixed determinable income. However see Reportable payments to corporations later.

Due to the high level of. Payments for which a Form 1099-MISC is not required include all of the following. Gross proceeds arent fees for an attorneys legal services.

Form 1099-NEC Nonemployee Compensation is transmitted with Form 1096 Annual Summary and Transmittal of US. 1099-MISC forms report to the IRS exactly how much a company has paid you in the last tax year as a non-employee they are the alternative to W-2 forms which. Person and the services are wholly performed outside the US then no Form 1099 is required and no withholding is required.

This payment would have been for services performed by a person or company who IS NOT the payors employee. Use Form 1099-NEC to report payment of attorney fees for services. Payments to corporations are also reportable on other 1099 forms.

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

1099 Tax Form Regulations Tax Preparation Pittsburgh

1099 Tax Form Regulations Tax Preparation Pittsburgh

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc