Employer Duplicate W2 Form

Most employers give Forms W-2 to their workers by Jan. Social Security Number Randomization Frequently Asked Questions.

Official W2 Forms At Lower Prices Every Day Discounttaxforms Com

Official W2 Forms At Lower Prices Every Day Discounttaxforms Com

After SSA processes it they transmit the federal tax information to the IRS.

Employer duplicate w2 form. It may take up to 75 calendar days for the IRS to process your. Each year employers must send Copy A of Forms W-2 Wage and Tax Statement to Social Security to report the wages and taxes of your employees for the previous calendar year. Once you have contacted them the IRS will follow up with the employer.

This normally occurs by January 31st of each year. Keep Copy D and a copy of Form W-3 with your records for 4 years. You can find this on a previous W-2 or ask your employer directly.

In addition a Form W-2 must be given to each employee. If your W-2s have a different Employer Identification Number EIN in box b enter each one separately. In the event you lose your W2 or require a duplicate copy for another reason you can request one.

Your employer first submits Form W-2 to SSA. Electronic Data Transfer Guide. Depending on the time of year the IRS may have federal wage information in the form of a wage transcript.

The quickest way to obtain a copy of your current year Form W-2 is through your employer. Once the correct details appear you will be given directions for importing your W2. If you did not receive your original Form W-2 or if you received it but misplaced it contact the Interior Business Center IBC Customer Support Center directly at.

W2s are mailed to your home address or routed to your department for distribution. See Topic 159 for more information on how to get a transcript of W-2 information. This requires a fee of 50.

And Copies B C and 2 to your employee. Some employers will reissue the W-2 immediately on your request but according to IRS regulations employers are only required to do so within a reasonable amount of time This could be a few days or weeks depending on the size of your organization. Do not print Forms W-2 Copy A on double-sided paper.

Ensure all copies are legible. If you need a duplicate W-2 for the current tax year please allow a reasonable delivery period from the date we first mail the originals. Request a Duplicate Form W-2.

Alternatively request Form 4852 as this allows you to estimate your wages and deductions based on the final payslip received. If youve lost your W-2 you can request a duplicate copy from your employer. To get a copy of the Form W-2 or Form 1099 already filed with your return you must use Form 4506 and request a copy of your return which includes all attachments.

You might get more than one W-2 if you work for an employment agency or your company changed ownership or payroll providers. All that you need is your employers name and their FEIN Federal Employer Identification Number. Failing that you can also download Form 4506-T which has a breakdown of the W-2 information that has been reported by your employer.

Review your paper Forms W-2 especially Copy A to ensure that they print accurately prior to mailing them to Social Securitys Wilkes-Barre Direct Operations Center. Copy 1 if required to your state city or local tax department. They may need to file Corrected W-2 forms.

You should first ask your employer to give you a copy of your W-2. If employers send the form to you. Form W-2 is a multi-part form.

If you havent received yours by mid-February heres what you should do. Publication 15 Circular E Employers Tax Guide--Reporting Sick Pay. Send Copy A to the SSA.

You can use the Form 4852 in the event that your employer doesnt provide you with the corrected Form W-2 in time to file your tax return. Form W-2W-3 Instructions Form W-2cW-3c Instructions. Duplicate W2 Forms Yes definitely contact the former employer to find out what happened in your situation.

Forms W-2 are sent to Social Security along with a Form W-3 Transmittal of Income and Tax Statements. If you cant get your Form W-2 from your employer and you previously attached it to your paper tax return you can order a copy of the entire return from the IRS for a fee. Youll also need this form from any former employer you worked for during the year.

If you do not receive your W2 by the end of January you should contact your PersonnelPayroll Office. Every employer engaged in a trade or business who pays remuneration including noncash payments of 600 or more for the year all amounts if any income social security or Medicare tax was withheld for services performed by an employee must file a Form W-2 for each employee even if the employee is related to the employer from whom. If your W-2s are identical down to the last number and letter just enter one of them.

Social Security accepts laser printed Forms W-2W-3 as well as the standard red drop-out ink forms. Electronic Wage Reporting Forms W-2 Specifications for Filing Forms W-2 and W-2c Electronically EFW2EFW2C Tax Year 2020 Substitute W-3W-2 2-D Barcoding Standards.

W2 Correction Forms Copy C Employee File Discount Tax Forms

W2 Correction Forms Copy C Employee File Discount Tax Forms

W2 Forms Set Preprinted Forms Discount Tax Forms

W2 Forms Set Preprinted Forms Discount Tax Forms

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

How To Get Your W2 Form Online For Free 2020 2021

How To Get Your W2 Form Online For Free 2020 2021

Quickbooks W2 Copy A Red Form For Federal Discounttaxforms Com

Quickbooks W2 Copy A Red Form For Federal Discounttaxforms Com

Form W2 Everything You Ever Wanted To Know

Form W2 Everything You Ever Wanted To Know

Instant W2 Form Generator Create W2 Easily Form Pros

Instant W2 Form Generator Create W2 Easily Form Pros

Lost Wages Form Template Awesome Template Gallery Page 121 Templates Business Template Gift Certificate Template

Lost Wages Form Template Awesome Template Gallery Page 121 Templates Business Template Gift Certificate Template

W2 Form Sets Envelopes At Lower Prices Discounttaxforms Com

W2 Form Sets Envelopes At Lower Prices Discounttaxforms Com

W2 Forms Copy B Employee Federal Discount Tax Forms

W2 Forms Copy B Employee Federal Discount Tax Forms

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Payroll Template Debt Relief

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Payroll Template Debt Relief

W3 Transmittal Forms Discount Tax Forms

W3 Transmittal Forms Discount Tax Forms

W2 Forms Copy B Employee Federal Zbp Forms

W2 Forms Copy B Employee Federal Zbp Forms

Free W2 Form 2016 3 Ways To Get Copies Of Old W 2 Forms Wikihow Irs Forms W2 Forms Job Application Form

Free W2 Form 2016 3 Ways To Get Copies Of Old W 2 Forms Wikihow Irs Forms W2 Forms Job Application Form

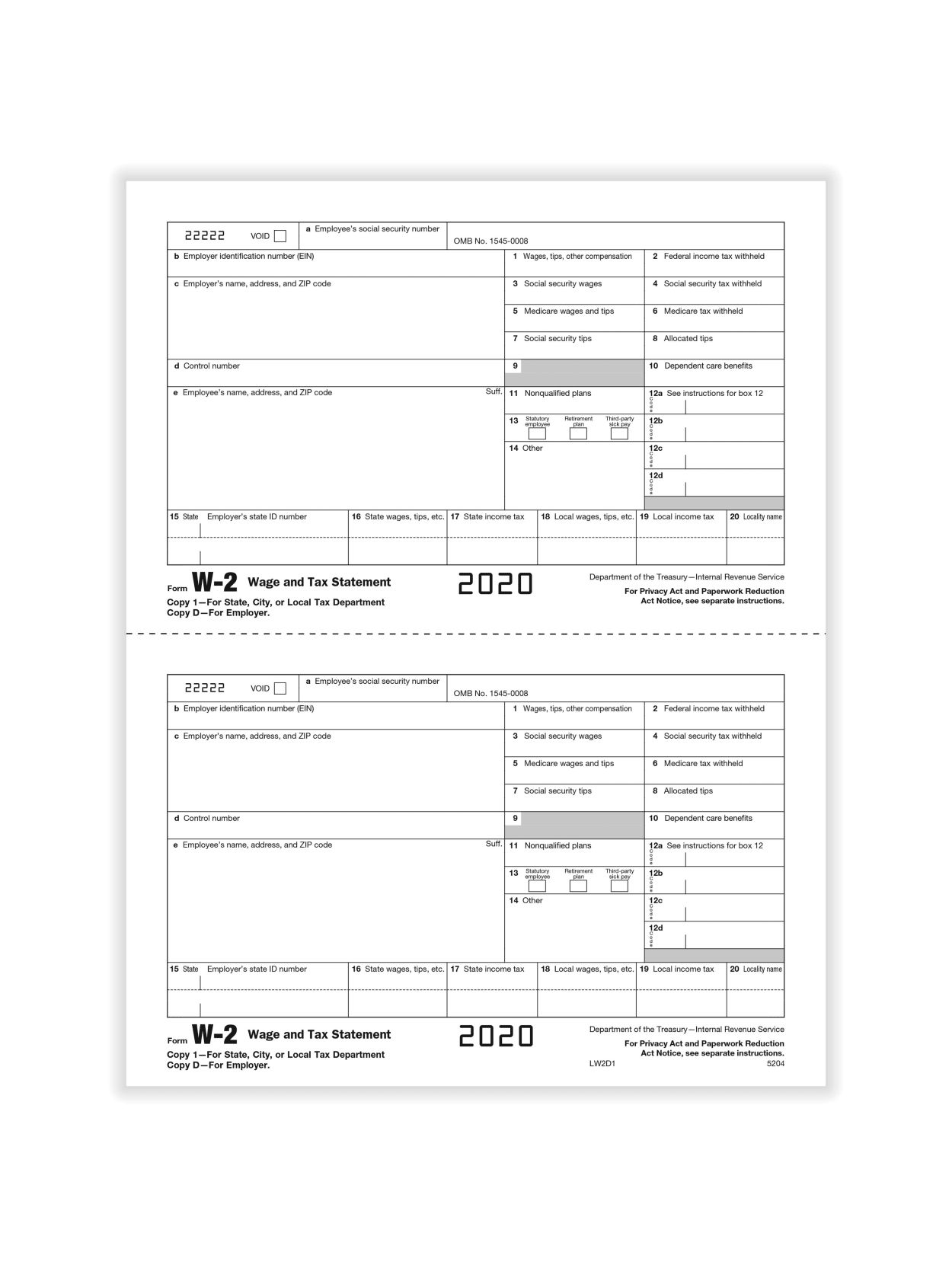

Condensed W2 Forms Copy 1 D Employer Discount Tax Forms

Condensed W2 Forms Copy 1 D Employer Discount Tax Forms

How To Get Your W2 Form Online For Free 2020 2021

How To Get Your W2 Form Online For Free 2020 2021

Account Abilitys W 2c User Interface Corrected Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Business Tax Tax Accountant Irs Forms

Account Abilitys W 2c User Interface Corrected Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Business Tax Tax Accountant Irs Forms