Schedule K-1 Form 1065 Turbotax

2020 12092020 Inst 1041 Schedule K-1 Instructions for Schedule K-1 Form 1041 for a Beneficiary Filing Form 1040 2020 12112020 Form 1065 Schedule K-1. Explanation of Certain Line Items on Schedule K-1 TIP.

Instructions for Schedule K-1 Form 1065.

Schedule k-1 form 1065 turbotax. I received two K-1 forms after my fed return has been accepted. Form 1065 US. If you are using any version of TurboTax online you will not be able to import the K-1 into the program you will need to manually enter it.

Personal tax returns should not be filed without the Schedule K-1 included. For deadlines see About Form 1065 US. Form 1041 Schedule K-1 Beneficiarys Share of Income Deductions Credits etc.

Schedule K-1 Form 1065 2020. On smaller devices click the menu icon in the upper left-hand corner then select Federal Click Business Income to expand the category and then click Partnership income Form 1065 Schedule K-1. In each instance that follows the first line reference is to the Schedule K-1 for Form 1065 and the second line reference is to the Schedule K-1 for Form 1120S Line 16 code B or line 14 code BGross income from all sources.

Combine your distributive share of gross income from all sources with all of your other gross income and. Another form 1065 has 0s for all entries in Part III and I entered the. I know how to enter 1099-INT 1099-DIV Schedule D but not schedule-K.

The Schedule K-1 is the form that reports the amounts that are passed through to each party that has an interest in the entity. Partnerships and S corporations file Forms 1065 and 1120-S respectively while individuals file a Schedule K-1 with their personal tax returns. K-1 Forms for business partnerships For businesses that operate as partnerships its the partners who are responsible for paying taxes.

Where do I find form 1065 schedule k-1. Heres a summary of each page. Schedule K-1 Form 1065 Schedule K-1 Form 1065 - Tax Exempt Income Non-Deductible Expenses Distributions and Other Items including Section 199A entries This article focuses solely on the entry of the Tax Exempt Income Non-Deductible Expenses Distributions and.

Department of the Treasury Internal Revenue Service. Return of Partnership Income is used to help report a gain or loss in partnership business on each partners Schedule K-1. Determine whether the income loss is passive or nonpassive and enter on your return as follows.

The partnership files a copy of Schedule K-1 Form 1065 with the IRS to report your share of the partnerships income deductions credits etc. IRS Form 1065 is five pages long. A description of the income items contained in boxes 1 through 11 including each of the Codes for Other Income Loss that can be entered in.

Annual Return of Income. I am filing my personal tax form 1040. A Schedule K-1 Form 1065 is a sample used by partnerships that issue it to each partner involved in business.

For calendar year 2020 or tax year beginning 2020. Ordinary business income loss. Find below an explanation when to use it as well a short instruction for creating a template with ease.

Youll fill out Schedule K-1 as part of your Partnership Tax Return Form. A Schedule K-1 is required for partners in partnerships and shareholders of an S corporation. The due amount did not change.

Also there are Part I Part II and Part III mentioned in the schedule -K Form 1065. About Schedule K-1 Form 1065 Partners Share of Income Deductions Credits etc. Schedule K-1 is a schedule of IRS Form 1065 that members of a business partnership use to report their share of a partnerships profits losses deductions and credits to the IRS.

I have to enter K-1 that I received from company. Partners are not employees and shouldnt be issued a Form W-2. The type of documents depends on your activity and income.

Any help would be appreciated. If you are using TurboTax download or CD the steps above given by Heather14 will get you there. Partnerships employer identification.

The partnership as an entity may need to file the forms below. How is IRS Form 1065 is Used. Then I tried to amend my fed return.

The partnership must furnish copies of Schedule K-1 Form 1065 to the partner. I am not able to find out howwhere to enter using turbo tax. The K-1 1065 Edit Screen in the tax program has an entry for each box found on the Schedule K-1 Form 1065 that the taxpayer received.

Turbo Tax does not allow entry of a K-1 which has box 1 2 activity. One K-1 Form 1065 says Do not use information in Part III and I skipped the steps on Part III. Return of Partnership Income.

13 rows Inst 1065 Schedule K-1 Instructions for Schedule K-1 Form 1065 Partners Share of. Part I Information About the Partnership. Do I need TurboTax Premier to file Schedule K-1 Form 1065.

Ending Partners Share of Income Deductions Credits etc. It appears you need to separate the activity and then enter as two distinct documents. From within your TaxAct return Online or Desktop click Federal.

Passive loss See page 8 Passive income Schedule E Form 1040 line 28 column h Nonpassive loss See page 8 Nonpassive income Schedule E Form 1040 line 28 column.

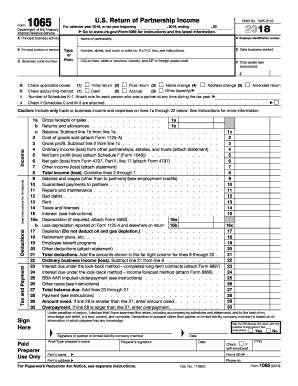

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

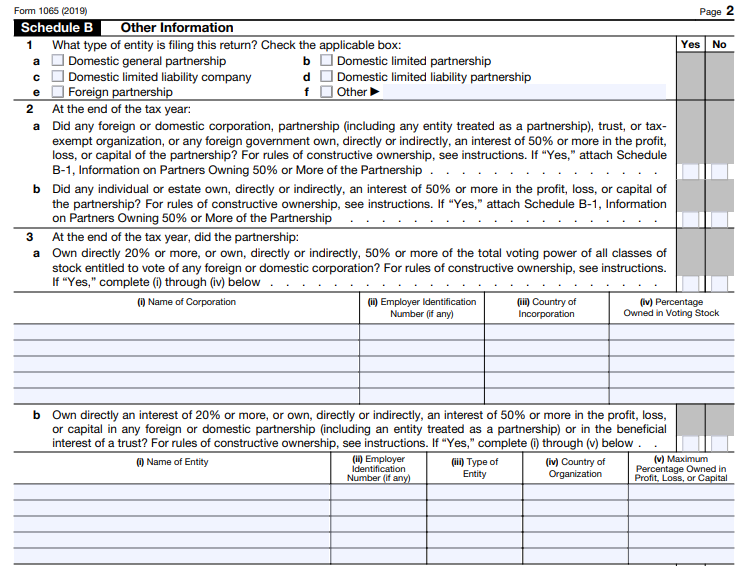

Form 1065 Fill Out And Sign Printable Pdf Template Signnow

Form 1065 Fill Out And Sign Printable Pdf Template Signnow

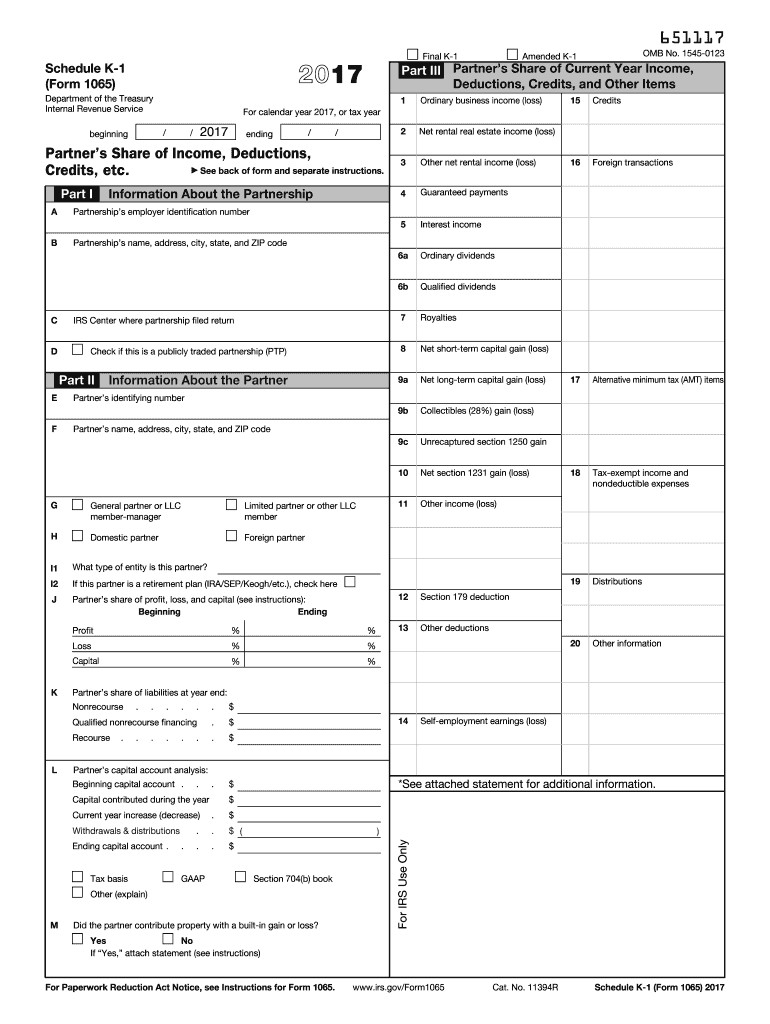

2017 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

What Is A Schedule K 1 Tax Form Turbotax Tax Tips Videos

What Is A Schedule K 1 Tax Form Turbotax Tax Tips Videos

Solved Re Form 1065 K 1 Part Iii Box 4c

Solved Re Form 1065 K 1 Part Iii Box 4c

Form 1065 Instructions In 8 Steps Free Checklist

Form 1065 Instructions In 8 Steps Free Checklist

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

How To Fill Out An Llc 1065 Irs Tax Form

How To Fill Out An Llc 1065 Irs Tax Form

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

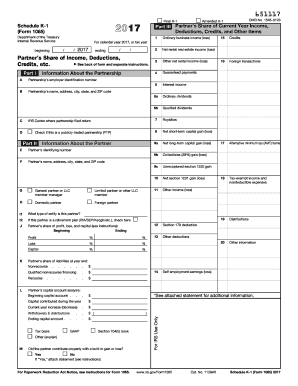

2017 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto