Business Mileage Reimbursement Rate 2020

For 2020 the federal mileage rate is 0575 cents per mile. Also for miles driven while helping a non-profit you can reimburse 14 cents per mile.

It does not matter if your employee.

Business mileage reimbursement rate 2020. This rate applies to both cars and trucks and fluctuates year by year. The 2020 Standard Mileage Reimbursement Rates are as follows. Kilometre rates for the 2019-2020 income year Use these rates to work out your vehicle expenses for the 2019-2020 income year.

575 cents per mile down from 58 cents in 2019 Charitable. The Internal Revenue Service announced gas mileage reimbursement rates for 2020 in December. Under the law the taxpayer for each year is generally entitled to deduct either the actual expense amount or an amount computed using the standard mileage rate.

575 cents per mile for business miles driven down from 58 cents in 2019 17. For 2020 the standard IRS mileage rates are. Starting January 1 2020 the IRS Standard mileage rate for transportation and travel expenses has declined to 575 cents per mile from 58 cents per mile in 2019.

In 2019 the IRS released a report that states non-profit business mileage can be reimbursed at 58 cents per mile. Beginning on January 1 2020 the standard mileage rates for the use of a car van pickup or panel truck will be. 17 cents per mile down from 20 cents in 2019 Moving.

This rate applies to both cars and trucks and fluctuates year by year. The non-profit reimbursement rate for mileage and other travel expenses. Reimbursements based on the federal mileage rate arent considered income making them nontaxable to your employees.

575 cents per mile for regular business driving. The Internal Revenue Service IRS has announced the 2021 Business Mileage Standard Rate of 56 cents. If youre making a reimbursement payment to someone the current rate applies until we provide the new rate.

575 cents per mile for regular business driving. 162 for the business use of a vehicle. Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

Each year the IRS sets a standard mileage reimbursement rate so contractors employees and employers can use them for tax purposes. IRS Standard Mileage Deduction Rates for 2020 and Previous Years. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate for 2020 and.

What are the 2020 mileage reimbursement rates. This 2020 rate is down from 2019s. 14 rows The following table summarizes the optional standard mileage rates for employees self.

This is the one that applies to most companies. The business purpose of the expense. See section 404 of.

Kilometre rates for business use of vehicles. 575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or. Employees must return any excess reimbursement or allowance within a reasonable period of time.

575 cents per business mile 17 cents per mile for medical or moving 14 cents for charitable reasons. The business mileage reimbursement rate is an optional standard mileage rate used in the United States for purposes of computing the allowable business deduction for Federal income tax purposes under the Internal Revenue Code at 26 USC. For this year the mileage rate in 2 categories have gone down from previous years.

Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. 20 cents per mile currently fixed by congress Check out the link below to read the original announcement from the IRS. Accordingly the 2020 IRS standard mileage rates are.

For 2020 the standard IRS mileage rates are. Each year the IRS sets a standard mileage reimbursement rate so contractors employees and employers can use them for tax purposes. For automobiles a taxpayer uses for business purposes the portion of the business standard mileage rate treated as depreciation is 24 cents per mile for 2016 25 cents per mile for 2017 25 cents per mile for 2018 26 cents per mile for 2019 and 27 cents per mile for 2020.

575 cents per mile for business miles 58 cents in 2019 17 cents per mile driven for medical or moving purposes 20 cents in 2019. As you can see the standard business mileage rate has stayed in the 50s cent range for the past decade. An employee must provide proof that the business expense is valid.

Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p plus 2000 x 25p.

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

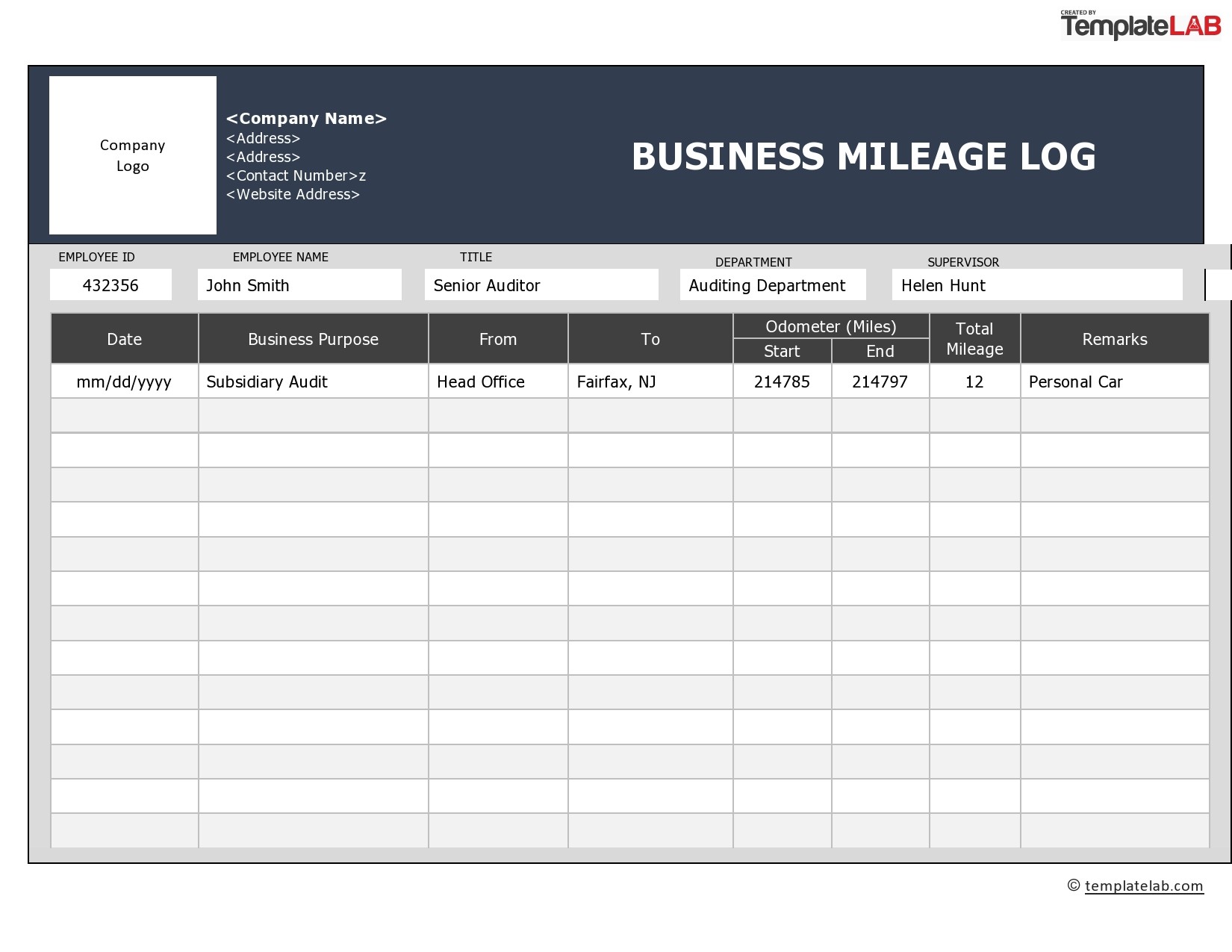

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

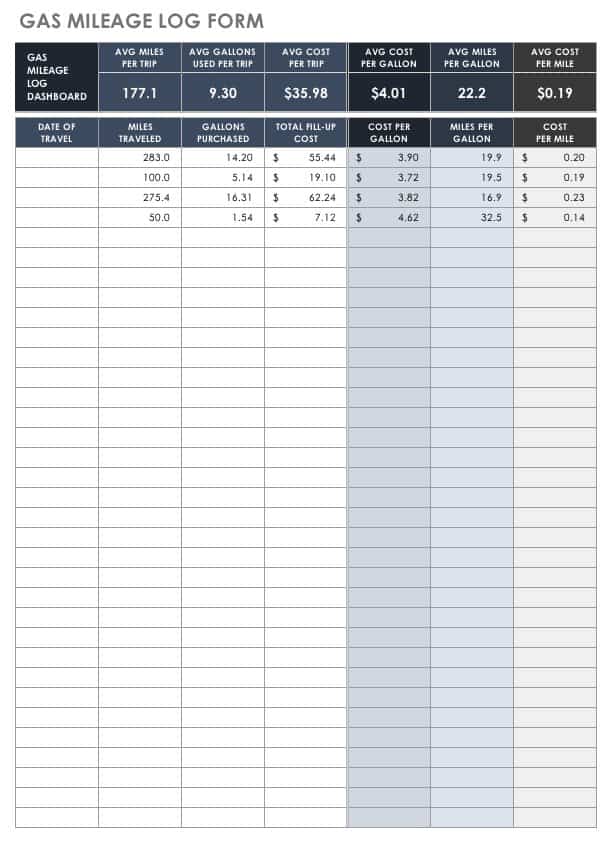

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

2021 Towing Service Cost Tow Truck Rates Prices Per Mile

What Are The Irs Mileage Rates Updated 2021 Bench Accounting

What Are The Irs Mileage Rates Updated 2021 Bench Accounting

Free Printable Free Mileage Log Templates For Excel And Word

Free Printable Free Mileage Log Templates For Excel And Word

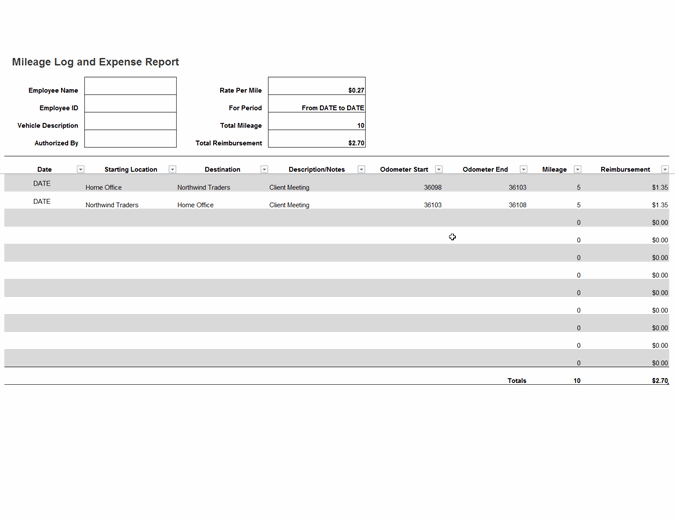

Mileage Log And Expense Report

Mileage Log And Expense Report

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

2020 Cra Mileage Rate Cra Car Allowance Rate Everlance

2020 Cra Mileage Rate Cra Car Allowance Rate Everlance

Free Expense Reimbursement Form Templates

Free Expense Reimbursement Form Templates

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

![]() Free Mileage Tracking Log And Mileage Reimbursement Form

Free Mileage Tracking Log And Mileage Reimbursement Form