What Is Interest Expense For Corporate Partners

Section 1260b information Section 1260b Code R. After inputting the info from the K-1 into TT there was a note that read Your Code N entry on box 20 for ___ is shown as an information item on your Schedule K-1.

Debt Vs Equity Finance Investing Accounting And Finance Business Money

Debt Vs Equity Finance Investing Accounting And Finance Business Money

Feb 18 2021 For partnerships any disallowed interest expense excess business interest passes through to the partners and does not carry to the next year.

What is interest expense for corporate partners. It does not impact your individual return. In general it limits a taxpayers interest expense deductions for a taxable year to the sum of 30 percent of adjusted taxable income ATI and its business interest income. Jul 31 2020 The business interest expense BIE of the partnership attributable to the lending transaction will thus be treated as BIE of the partnership for purposes of applying the business interest expense limitation at the partnership level.

Line 20N - Interest expense for corporate partners. Interest paid or accrued reduces earnings and profits in the year paid or accrued even if the deduction is deferred under Section 163j. The partnership will report each corporate partners distributive share of the partnerships interest expense.

Such excess business interest is treated as business interest of the partner in the next succeeding year in which the partner is allocated excess taxable income from such partnership. The partnership will report any self-charged. Sep 25 2020 Interest expense is a non-operating expense shown on the income statement.

Interest expense for corporate partners Section 163j Code O. Section 453Ac information Section 453Ac Code Q. Mar 01 2016 Interest Expense Related to Acquisition of a Pass-through Entity When acquiring an interest in a pass-through entity such as an interest in a partnership or an S corporation an acquisition made by an individual using borrowed funds leads to the question of ifhow you deduct the interest expense on the acquisition debt.

Any investment interest that a partnership pays or accrues that is allocated to a C corporation partner is treated by the C corporation as interest expense allocable to a trade or business by the C corporation partner. Jul 08 2020 A business interest expense is the cost of interest on a business loan used to maintain business operations or pay for business expenses. This amount is reported elsewhere on Schedule K-1 and the total amount is reported here for information only.

The distributive share of interest income is reported in Box 5 and the share of partnership liabilities is reported in Part. Jun 05 2019 The accompanying statement description reads Interest Expense for Corporate Partners - Passthrough. Interest income or expense that resulted from loans between you and the partnership or between the partnership and another partnership or S corporation if both entities have the same owners with the same proportional ownership interest in.

This value is rather significant it could positively affect. Dec 06 2018 Investment interest expense allocated to a C-corporation partner by a partnership is recharacterized as trade or business interest expense for the C-corporation partner. Section 453l3 information Section 453l3 Code P.

Apr 06 2020 Partnerships with fully deductible business interest expense then allocate both that business interest expense and any excess taxable income ETI ie partnership ATI that was not needed to offset partnership business interest expense in the section 163j calculation among their partners. This amount is reported elsewhere on the Schedule K-1 and the total amount is reported here for information only. Jul 17 2019 The excess business interest expense allocated to each partner may be carried forward by the respective partner indefinitely until the partnership has allocated sufficient excess taxable income.

- Amounts reported in Box 20 Code N are not reported on Form 1040. However 50 of the suspended business interest is fully. Line 20O - Section 453l3 Information.

Partners may not include other sources of income in an attempt to deduct excess business interest from a partnership. Any business interest expense that is disallowed is passed to the partners and is suspended at the partner level under the TCJA rules. Allocated ETI can be used by the partners as ATI in their partner-level 163j calculations while allocated business interest expense.

Interest allocable to production expenditures. In 2020 Partners of the partnership can deduct 130000 50 of 2019 disallowed interest of 260000 interest expense with no limitation and the remaining 130000 may be deducted subject to available excess business income. It represents interest payable on any borrowings bonds.

Business interest expenses may be deductible if the use of. Mar 21 2018 The newly enacted version of section 163 j limits deductions for business interest expense.

Hospital Information Management System Hospitality Management Health Care Services Health Management

Hospital Information Management System Hospitality Management Health Care Services Health Management

Strategy And The Business Model Mihai Ionescu Linkedin Business Development Strategy Corporate Strategy Business Analysis

Strategy And The Business Model Mihai Ionescu Linkedin Business Development Strategy Corporate Strategy Business Analysis

Writing Medical Resistant Resume With Samples Administrative Assistant Resume Resume Skills Job Resume

Writing Medical Resistant Resume With Samples Administrative Assistant Resume Resume Skills Job Resume

Resume Summary For Administrative Assistant Best Of Executive Summary Resume Admin Medical Assistant Resume Resume Summary Administrative Assistant Resume

Resume Summary For Administrative Assistant Best Of Executive Summary Resume Admin Medical Assistant Resume Resume Summary Administrative Assistant Resume

What Is Berkshire Hathaway Warren Buffett S Company In A Nutshell Fourweekmba Warren Buffett Berkshire In A Nutshell

What Is Berkshire Hathaway Warren Buffett S Company In A Nutshell Fourweekmba Warren Buffett Berkshire In A Nutshell

I Just Got An Awesome Income And Expense Tracking Worksheet For Excel From Vertex42 Com Spreadsheet Template Expense Tracker Excel Budgeting Worksheets

I Just Got An Awesome Income And Expense Tracking Worksheet For Excel From Vertex42 Com Spreadsheet Template Expense Tracker Excel Budgeting Worksheets

Microsoft Dynamics 365 Training Partner In Ohio Microsoft Dynamics Crm System Crm

Microsoft Dynamics 365 Training Partner In Ohio Microsoft Dynamics Crm System Crm

Pin On Professional Resume Templates Online

Pin On Professional Resume Templates Online

Fresh Non Profit Balance Sheet Template Personal Financial Statement Statement Template Business Plan Template Free

Fresh Non Profit Balance Sheet Template Personal Financial Statement Statement Template Business Plan Template Free

Partnership Management System Management System Partnership

Partnership Management System Management System Partnership

Browse Our Sample Of Event Partnership Agreement Template For Free Contract Template Event Sponsorship Professional Templates

Browse Our Sample Of Event Partnership Agreement Template For Free Contract Template Event Sponsorship Professional Templates

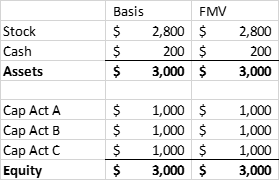

Application Of The Tax Basis And At Risk Loss Limitations To Partners

Application Of The Tax Basis And At Risk Loss Limitations To Partners

Formula For Cash Flow Bookkeeping Business Accounting Basics Finance

Formula For Cash Flow Bookkeeping Business Accounting Basics Finance

Partnership Taxation What You Should Know About Section 754 Elections

Partnership Taxation What You Should Know About Section 754 Elections

Simple Report Card Template Inspirational Simple Report Card Template Awesome Excel Expenses Open Excel Budget Template Budget Template Budgeting

Simple Report Card Template Inspirational Simple Report Card Template Awesome Excel Expenses Open Excel Budget Template Budget Template Budgeting

Partnership Vs Corporation Vs Sole Proprietorship Pesquisa Google Sole Proprietorship Corporate Flexibility

Partnership Vs Corporation Vs Sole Proprietorship Pesquisa Google Sole Proprietorship Corporate Flexibility

4 Tax Tips For Small Business Owners Tips Taxes Business Tax Small Business Business Advice

4 Tax Tips For Small Business Owners Tips Taxes Business Tax Small Business Business Advice