How To Find My 1099 Form On Turbotax

Click on the Tax Form and in the expanded view locate the Download Print Form option near the bottom. It should show all Forms 1099 issued under your Social Security number.

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

Part of the complication is the task of keeping track of the various types of taxable incomethere are 17 different versions of Form 1099and Kelleher said its common for people to receive five to 10 various 1099s in any year.

How to find my 1099 form on turbotax. If you are looking for 1099s from earlier years you can contact the IRS and order a wage and income transcript. Remember with TurboTax well ask you simple questions about your life and help you fill out all the right tax forms. A Social Security 1099 or 1042S Benefit Statement also called an SSA-1099 or SSA-1042S is a tax form that shows the total amount of benefits you received from Social Security in the previous year.

Your 1099s include many boxes but you usually only need to be concerned with one box on each form. Youll want to ask for a copy of the one they already sent you. From there click on the Tax Year at the top and select the appropriate year.

Well send your tax form to the address we have on file. Click to see full answer. Go to the Federal Taxes tab.

Sign in to TurboTax and open or continue your return. Answer Yes to Did you get a 1099-MISC. These report your gross earnings in each category.

If you dont see the Jump to link you can always do the following. If you already entered a 1099-MISC youll be on the 1099-MISC Summary screen in which case select Add Another 1099-MISC. Volunteers should encourage taxpayers to contact their employers first to obtain their missing Forms W-2s 1099s K-1 etc.

Search for 1099-misc and select the Jump-to link. You can verify or change your mailing address by clicking on Profile in the menu and then clicking on the Communication tab. Calling your client is usually the easiest way to get a copy of a lost Form 1099.

You might notice that the amount in Box 1a of 1099-K is larger than the total amount you actually got paid. The transcript should include all of the income that you had as long as it was reported to the IRS. Online Ordering for Information Returns and Employer Returns.

Sign in to your account click on Documents in the menu and then click the 1099-R tile. Whether you have a simple or. Select Wages.

Outsource it all to a tax pro. Search for the name of your form like 1099-B and select the Jump to link in the search results. This will start a download of your 1099 form.

Be sure to select the right financial institution or brokerage from the list. It is mailed out each January to people who receive benefits and tells you how much Social Security income to report to the IRS on your tax return. Transcripts will arrive in about 10 days.

Box 1a on 1099-K. Follow the screens and youll be able to import your form. To enter a 1099-MISC for miscellaneous income in TurboTax.

Then contact the Form 1099-G state issuing agency immediately and request a revised Form 1099-G showing you did not receive these benefits and make sure you dont report them on your tax return. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS. All Revisions for Form 1099-R and Instructions.

You can do a search for 1099-G from inside your return and in the results you should see a Jump to link for it. Use IRS Get Transcript. However the 1099 can complicate your tax return he said.

Your customer or the issuer is required to keep copies of the 1099s it gives out to non-employees. Call 800 908-9946 or go to Get Transcript by Mail. Many people use automated tax-return programs such as the Internet-based TurboTax to help them report this income correctly and avoid penalties from the Internal Revenue Service IRS.

Noncitizens who live outside of the United States receive the SSA-1042S instead of the SSA-1099. Open or continue your return if youre not already in it. If for some reason they cant find.

Hit See List of All Income. Beware taxpayers have been able to pass the strict authentication process only 30 of the time. Set up an IRS account and download your transcripts online.

A 1099-R form records distributions you received during the year from certain retirement accounts including 401 k 403 b and IRA accounts. However when taxpayers are unable to find their employers or cannot otherwise secure copies they can. An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS.

Look for the 1099-G form under the Unemployment and Paid Family Leave section. Box 1 on 1099-NEC. Publication 1220 PDF Specifications for Filing Forms 10971098 1099 3921 3922 5498 8935and W2-G Electronically PDF Additional Publications You May Find Useful.

Income listed on a 1099-R form can be taxable or tax-free and if you have withdrawn money before retirement age may be subject to early distribution penalties.

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

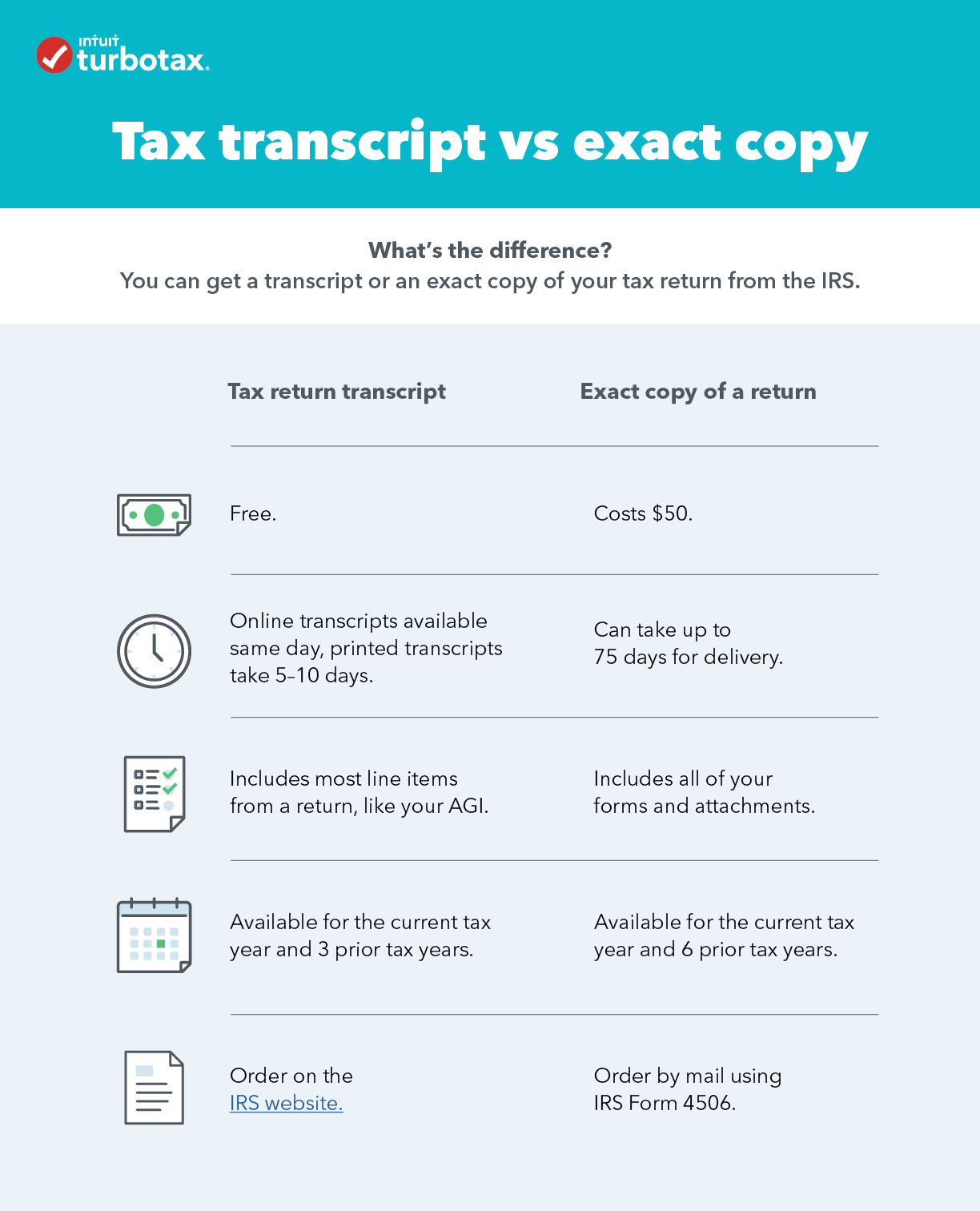

How Do I Get A Copy Of My Tax Return Or Transcript

How Do I Get A Copy Of My Tax Return Or Transcript

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

Solved Where Do I Enter The Information From My 1099 R In Turbotax

Solved Where Do I Enter The Information From My 1099 R In Turbotax

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Re How Do I Link To Schedule C On My 1099 Misc Fo

Re How Do I Link To Schedule C On My 1099 Misc Fo

Importing Tax Data From Computershare Into Turbotax

Importing Tax Data From Computershare Into Turbotax

There Is A 1099 B On My Brokerage Statement

There Is A 1099 B On My Brokerage Statement

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

1099 Nec Schedule C Won T Fill In Turbotax

1099 Nec Schedule C Won T Fill In Turbotax

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

Re How To Report Graduate Student Stipend In Turb

Re How To Report Graduate Student Stipend In Turb