Sba Disaster Loan Use Guidelines

SBA can make loans to repair rehabilitate or replace property real or personal damaged or destroyed by or as a result of natural or other disasters as defined by the Small Business Act. The SBA sets the guidelines that govern the 7a loan program.

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

In fact if you meet the eligibility requirements the interest on your SBA disaster loan wont exceed four percent.

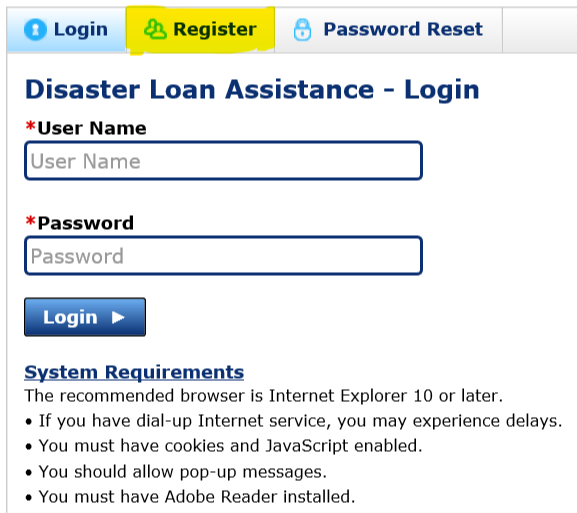

Sba disaster loan use guidelines. COVID-19 Economic Injury Disaster Loan. The loan amount will be based on your actual economic injury and your companys financial needs regardless of. DisasterLoansbagov There is no cost to apply There is no obligation to take the loan if offered The maximum unsecured loan amount is 25000 Applicants can have an existing SBA Disaster Loan and still qualify for an EIDL for this disaster but the loans cannot be.

SBA can provide up to 2 million to help meet financial obligations and operating expenses that could have been met had the disaster not occurred. Before a business begins allocating funds to the various expenses that are piling up its important to note that the SBA states These loans may be used to pay fixed debts payroll accounts payable and other bills that cant be paid because of the disasters impact That means these loans cant be used to make repairs like renovations expansions pay for bonuses or refinance long. SBA also provides eligible small businesses and nonprofit organizations with working capital to help overcome the economic injury of a declared disaster.

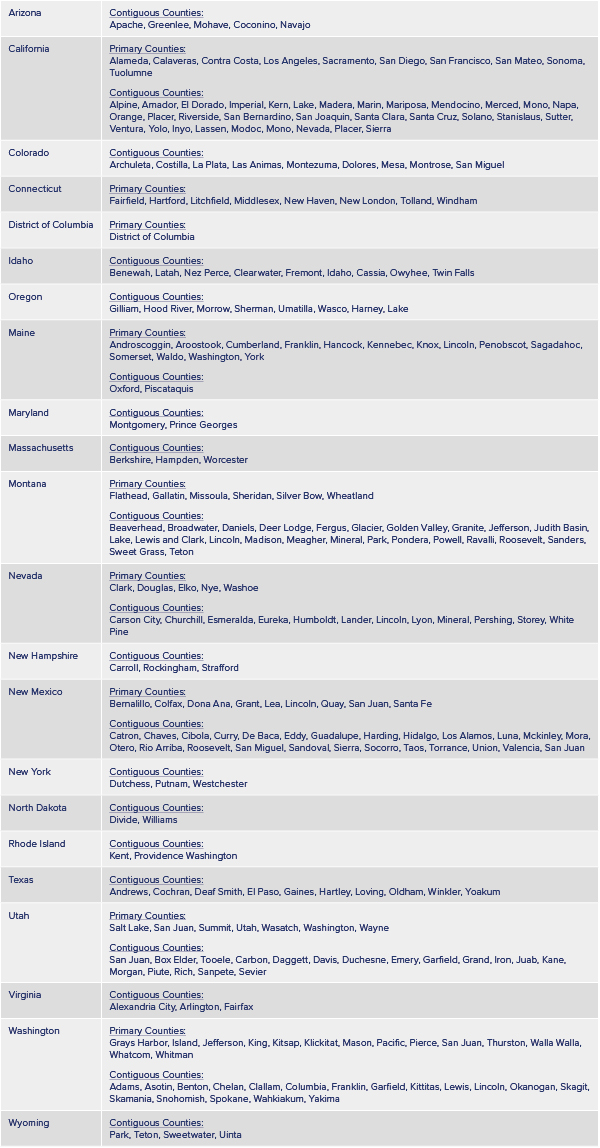

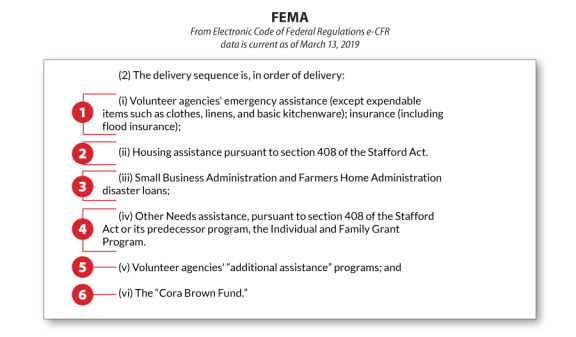

Economic Injury Disaster Loan Program Decision Criteria The EIDL program is part of a long-standing Small Business Administration SBA program that is meant to provide economic support to businesses non-profits and other entities affected by natural or other physical disasters. Treasury Apply directly to SBAs Disaster Assistance Program at. Who can use an SBA disaster loan.

As a lender these conditions determine which businesses you can lend to and the type of loans you can give. The SBA offers disaster assistance in the form of low interest loans to businesses nonprofit organizations homeowners and renters located in regions affected by declared disasters. Physical Disaster Loans Physical Disaster Loan proceeds may be used for the repair or replacement of the following.

Repair or replace disasterdamagedproperty owned by the business including real estate inventories supplies machinery and equipment. Real property Machinery Equipment Fixtures Inventory Leasehold improvements In addition disaster loans to repair or replace real property or leasehold improvements may be increased by as much as 20 percent of the total amount of disaster damage to real estate andor leasehold. This loan provides economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue.

But dont go thinking that you could use one to expand your operations. Agricultural business with 500 or fewer employees that has suffered substantial. An SBA disaster loan can be used to repair or replace real estate personal property machinery and equipment and inventory and business assets.

The SBA sets the guidelines that govern the 7a loan program. The rules clearly state that its only intended to restore things to the way they were before the disaster. Beginning April 6 small businesses and non-profits can apply for up to 24 months of relief with a maximum loan amount of 500000 the Small Business Administration announced.

Collateral is required for loans over 25000 If you obtain an EIDL loan for. Funds come directly from the US. Business Physical Disaster Loans.

As a lender these conditions determine which businesses you can lend to and the type of loans you can give. An SBA disaster loan is provided by the SBA to provide relief to businesses enduring physical and economic damage caused by devastating events including hurricanes droughts fires or pandemics such as the novel coronavirus. Although disaster loan assistance is available for up to 2 million the EIDL for COVID-19 was capped at 150000.

Section 7b2 of the Small Business Act as amended authorizes the Agencys Economic Injury Disaster Loan EIDL Program. A physical disaster loan from the SBA on the other hand carries a maximum loan amount of 2000000 and may be paid back over. If you are a small business nonprofit organization of any size or a US.

SBA Disaster Loan Program Frequently Asked Questions Whattypes of SBA Disaster Loans are available.

Https Www Sba Gov Sites Default Files Articles Eidl Information And Documentation 3 27 2020 Final Pdf

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Sba Disaster Loan Program Frequently Asked Questions Everycrsreport Com

Sba Disaster Loan Program Frequently Asked Questions Everycrsreport Com

How To Fill Out The Sba Disaster Loan Application Youtube

How To Fill Out The Sba Disaster Loan Application Youtube

Http Asbdc Org Library Sba 20disaster 20loan 20 20proceeds Pdf

Sba S Economic Injury Disaster Loan Program

Sba S Economic Injury Disaster Loan Program

Sba Economic Injury Disaster Loan Faq Small Business Development Center

Sba Economic Injury Disaster Loan Faq Small Business Development Center

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 8 2020 2 Pm Pdf

Https Www Sba Gov Sites Default Files Articles Eidl Information And Documentation 3 27 2020 Final Pdf

Https Www Sba Gov Sites Default Files Sops Sop 50 30 8 Pdf

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 15 2020 10am Pdf

Sba S Economic Injury Disaster Loan Program

Sba S Economic Injury Disaster Loan Program

Fema And Sba Disaster Assistance For Individuals And Households Application Processes Determinations And Appeals Everycrsreport Com

Fema And Sba Disaster Assistance For Individuals And Households Application Processes Determinations And Appeals Everycrsreport Com

Step By Step Guide To The Sba S Economic Injury Disaster Loans For Coronavirus Related Economic Disruptions Ihcc Business

Step By Step Guide To The Sba S Economic Injury Disaster Loans For Coronavirus Related Economic Disruptions Ihcc Business

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 15 2020 10am Pdf

Https Www Sba Gov Sites Default Files Articles Eidl Information And Documentation 3 27 2020 Final Pdf

Federal Disaster Relief Programs Sba Forsberg Real Estate

Federal Disaster Relief Programs Sba Forsberg Real Estate