What Does A 1099 K Show

Since the 1099 also includes the taxpayers social security number SSN the. In the eyes of the IRS it is pure income or profit and will be taxed accordingly.

Amazon Seller Income Tax And Sales Tax Reporting The Ultimate Guide

Amazon Seller Income Tax And Sales Tax Reporting The Ultimate Guide

A 1099 form is a record of income.

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

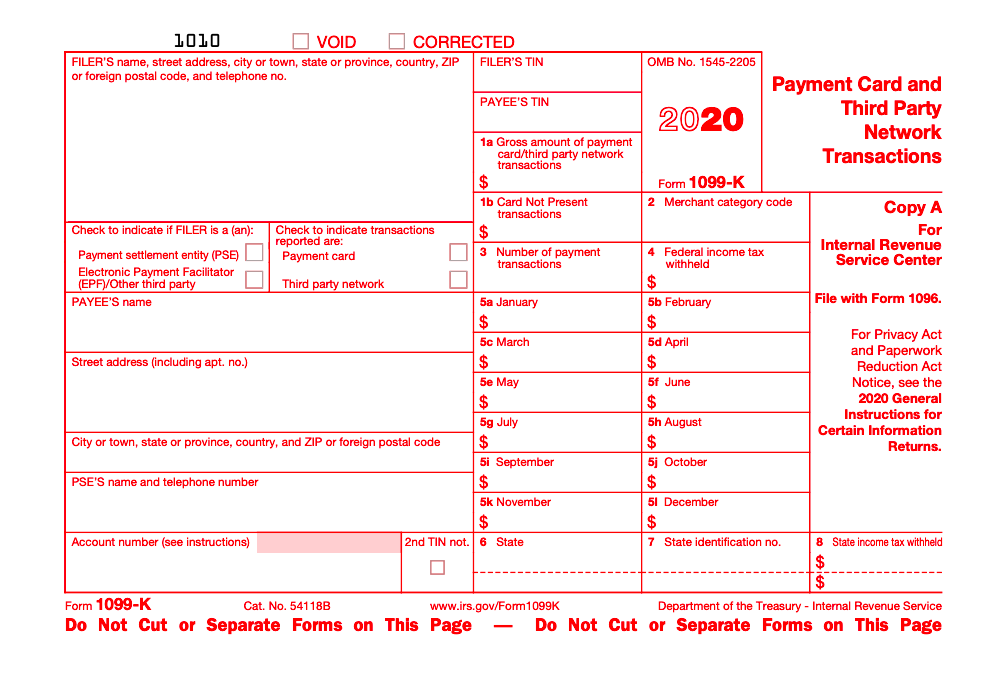

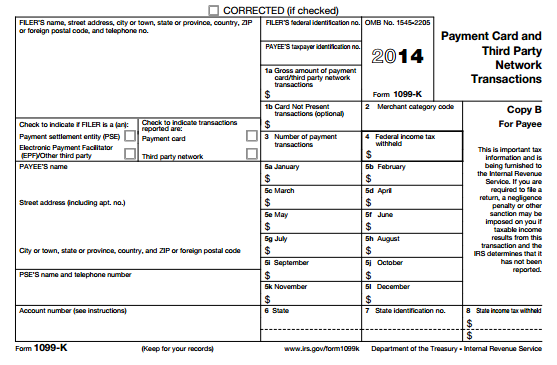

What does a 1099 k show. Form 1099-K Payment Card and Third Party Network Transactions is used to report transactions that are made via a payment settlement entities. So if you received any of these kinds of payments during the tax year you may receive Form 1099-K. Form 1099-K shows the value of the transactions the PSE has processed for you in the past year as well as any expenses paid on your behalf by your clients.

The 1099 is another form that is connected to the tax return and serves as evidence that income is paid to a specific taxpayer. IRS Form 1099-K came into existence as part of the 2008 Housing Assistance Tax Acteven though it has nothing to do with housing. About Form 1099-K Payment Card and Third Party Network Transactions A payment settlement entity PSE must file Form 1099-K for payments made in settlement of reportable payment transactions for each calendar year.

Form 1099-K is used to report income received from electronic payments such as credit cards debit cards PayPal and other third party payers. When a 1099-K or any 1099 for that matter gets generated a copy is sent to you and a copy is sent to the IRS. Gross sales includes all of your selling transactions meaning the totals of all of your sales.

EBay and PayPal fees are NOT taken out of the gross sales number. It contains a lot of information so verify that everything on the form is correct. Prior to the update the IRS required the payment settlement entities to report all the payment transactions amounting to at least 20000 in a year with a transaction limit of up to 200 per customer.

Scroll down to Less Common Income and click start to to right of Miscellaneous Income 1099-A 1099-C Say Thanks by clicking the thumb icon in a post Mark the post that answers your question by clicking on Mark as Best Answer View solution in. If you dont you could run. In most cases the payment settlement entity PSE will send you a 1099-K by January 31.

A 1099 is another option for stating income besides the W-2. Form 1099-K is a form the IRS requires payment-settlement entities to use to report certain payments received through reportable payment card transactions andor settlement of third-party payment network transactions. The 1099-K is an important form when you report business income on your tax return.

Your 1099-K shows your gross sales. Form 1099-K Threshold Lowered From 20000 To 600. The purpose of the form is to help improve voluntary tax compliance.

From the Massachusetts Department of Revenue. Simply put if you use a service to process credit or debit card transactions that service is a payment settlement entity and the amount of those types of transactions for the year should be reported on the Form 1099-K. This form endeavors to ensure that all online retailers are reporting sales for tax purposes.

Your personal or corporate tax returns must show this 1099-K and it must match the amounts in the IRSs database. Refunds and returns are also NOT deducted from your gross sales number. Form 1099-K is an IRS information return that includes the gross amount of all payment transactions you received within a calendar year.

This income needs to be included in your total business earnings. What does this 1099-K mean. If you receive either a federal Form 1099-K or a Massachusetts Form M-1099-K that shows amounts paid to you you must report taxable amounts on Schedule X as other income or if such amounts are derived from a trade or business on Schedule C.

Purpose of the 1099-K. For example freelancers and independent contractors often get a. All kinds of people can get a 1099 form for different reasons.

Form 1099 K Everything You Need To Know Bench Accounting

Form 1099 K Everything You Need To Know Bench Accounting

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Everything You Need To Know Bench Accounting

Form 1099 K Everything You Need To Know Bench Accounting

/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

1099 Misc 1099 K Explained Help With Double Reporting Paypal And Coinbase Youtube

1099 Misc 1099 K Explained Help With Double Reporting Paypal And Coinbase Youtube

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition