What Types Of Businesses Need A 1099

Traditionally third-party settlement organizations have used this. Operating for gain or profit.

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

The IRS requires individuals small businesses companies financial institutions and others to report money or bartered value of a service or commodity as income each tax year.

What types of businesses need a 1099. The 1099-INT form is usually used by banks brokerage firms credit unions and sometimes even the companies handling your student loans. 1099s are used to report a wide range of financial transactions. The form serves two purposes.

Who Must Send a 1099-MISC Form. Generally any time you pay someone 600 or more in a year for services in the course of your trade or business you must issue a 1099 form after. You will need to provide a 1099 to any vendor who is a.

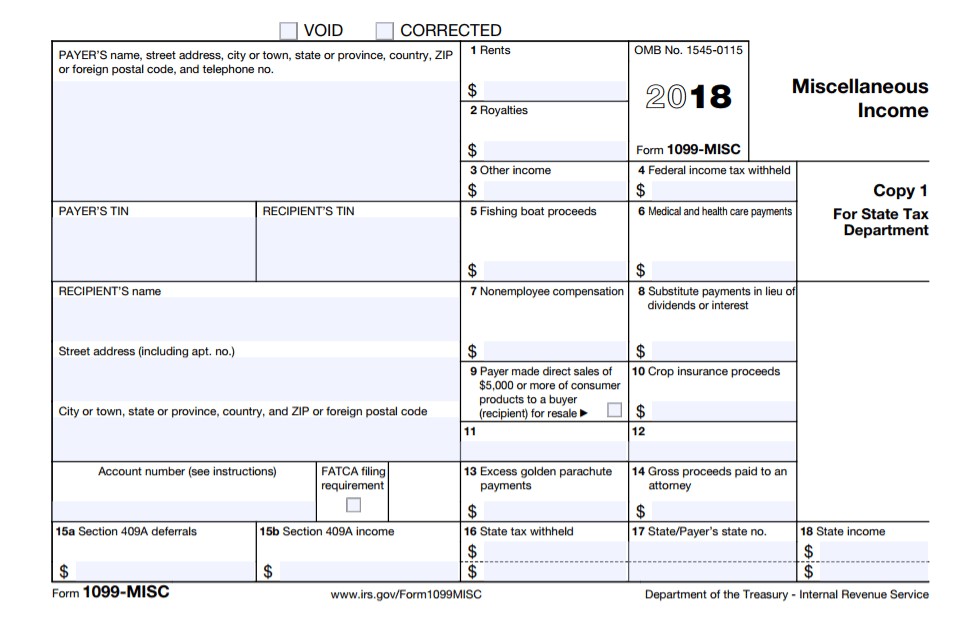

If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. If You Paid Someone 10 Or More For Natural Resources Forestry or Conservation Grants. Information about Form 1099-MISC Miscellaneous Income including recent updates related forms and instructions on how to file.

A non-exempt farmers cooperative. 600 Threshold for 1099-MISC. It allows you to report this wage information to the IRS and also allows your associate to do his or her taxes.

In general all economic relief payments to for-profit nonincorporated businesses eg sole proprietors individuals partnerships etc should be reportable as taxable grants. This form records income received from brokerage transactions and barter exchanges. Accordingly nonprofit organizations and government entities would generally be.

Form 1099-MISC provides information to the IRS that helps it track independent contractor income akin to the. The exception to this rule is with paying attorneys. What Businesses Are Exempt From a 1099.

A trust of a qualified employer pension or profit-sharing plan. If you paid a vendor more than 10 in interest youve got to send out a 1099-INT. Form 1099 comes in various versions depending on the payment type.

A 1099 is an IRS Internal Revenue Service tax form known as an information return. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099. There nearly as many 1099 forms as their are ways to earn extra income.

The 1099-MISC is used to report other types of income but the W. Corporation Exemption for Form 1099-MISC. A widely held fixed investment trust.

There are several types of 1099 forms but the most common is the 1099-MISC which is used to report miscellaneous income. You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate. Does an Independent Contractor Need a Business License.

As online and digital payments become more pervasive many companies may need to issue a Form 1099-K which is typically reserved for electronic payments and payments by credit card to contractors. It can be required of you if you paid someone 600 or more during the tax year. A non-profit organization including 501 c3 and d organizations.

Form 1099-MISC is used to report rents royalties prizes and awards and other fixed determinable income. Here are a few common 1099 forms. If you have paid any part-time workers or freelancers more than 600 during the year you will need to send them a 1099 form.

While some states require all businesses to have a license others may require it depending on what kind of work you do.

Form 1099 Misc 2018 Credit Card Services Form Electronic Forms

Form 1099 Misc 2018 Credit Card Services Form Electronic Forms

Filing Form 1099 Misc For Your Independent Contractors Small Business Tax Small Business Tax Deductions Filing Taxes

Filing Form 1099 Misc For Your Independent Contractors Small Business Tax Small Business Tax Deductions Filing Taxes

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

How To File Your Monthly Taxes Bookkeeping Business Small Business Bookkeeping Business Tax

How To File Your Monthly Taxes Bookkeeping Business Small Business Bookkeeping Business Tax

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

5 Things You Need To Know As A 1099 Employee Usa Today Classifieds Irs Forms Paying Taxes Paid Social

5 Things You Need To Know As A 1099 Employee Usa Today Classifieds Irs Forms Paying Taxes Paid Social

It S That Time Of Year Again Tax Season This Month There S An Important Form You Must Send Out To Those Who Ve Worked What Is A 1099 Business Blog Tax Season

It S That Time Of Year Again Tax Season This Month There S An Important Form You Must Send Out To Those Who Ve Worked What Is A 1099 Business Blog Tax Season

I Am A Business Owner Do I Need To File 1099 Misc For My Independent Contractors Irs Forms Irs Tax

I Am A Business Owner Do I Need To File 1099 Misc For My Independent Contractors Irs Forms Irs Tax

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose