Where Do I Mail My 1099 Misc Forms

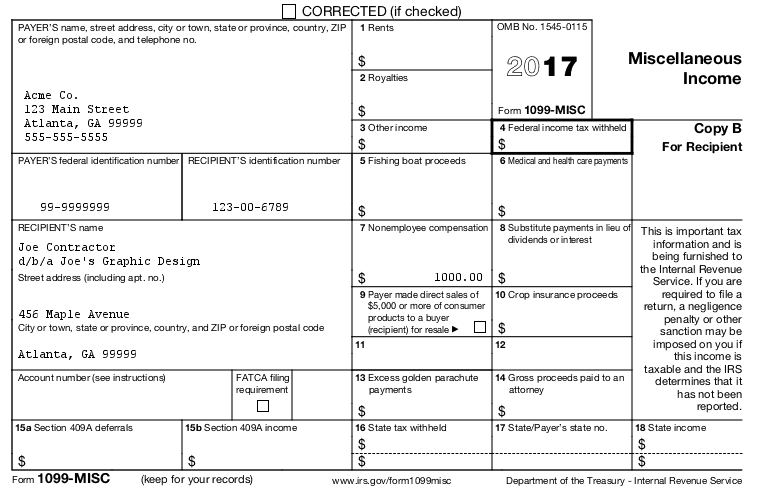

We recommend you file Form 1099-MISC as a stand-alone shipment by January 31 2019 if you are reporting nonemployee compensation NEC in box 7 which I am. If this form is incorrect or has been issued in error contact the payer.

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

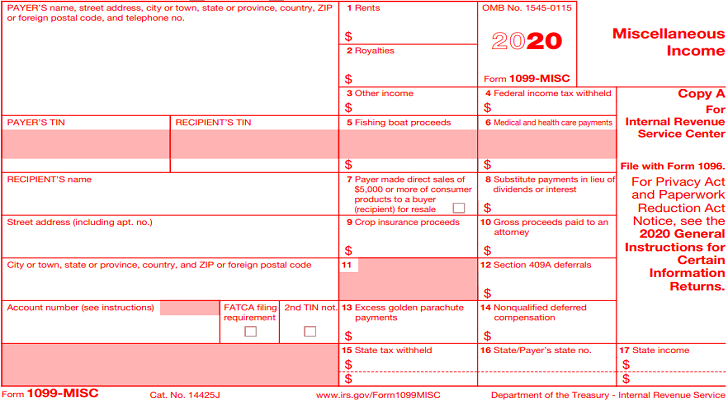

The IRS has introduced Form 1099-NEC for the 2020 tax year making a distinction between payments to non-employees and other types of miscellaneous payments a business might make.

Where do i mail my 1099 misc forms. You will need to file Form MO-96 with Forms 1099-MISC. Online W4 W9 W8s Form W-4 Form W-9 Free Form W-8BEN. Do I mail Form 1096 in the same envelope as Form 1099-MISC or do I mail each form separately in its own envelope.

Some states require separate notification from the employer that they are filing 1099 forms through the CFSF Program. If they dont respond or consent to e-delivery mail delivery is required. Error contact the payer.

If this form is incorrect or has been issued in Box 10. Alabama Arizona Arkansas Delaware Florida Georgia Kentucky Maine Massachusetts Mississippi New Hampshire New Jersey New Mexico New York North Carolina Ohio Texas Vermont Virginia. Report rents from real estate on Schedule E Form 1040 or 1040-SR.

Forms 1099 come in many varieties including 1099-INT for interest 1099-DIV for dividends 1099-G for tax refunds 1099-R for pensions and 1099-MISC for. First void the original Form 1099-MISC. The IRS address you should mail Form 1099-NEC to depends on your state.

Instructions for Forms 1099-MISC and 1099-NEC Print Version PDF. If you cannot get this form corrected attach an explanation to your tax return and report your income correctly. If you filed a 1099-MISC when you needed to submit a 1099-NEC.

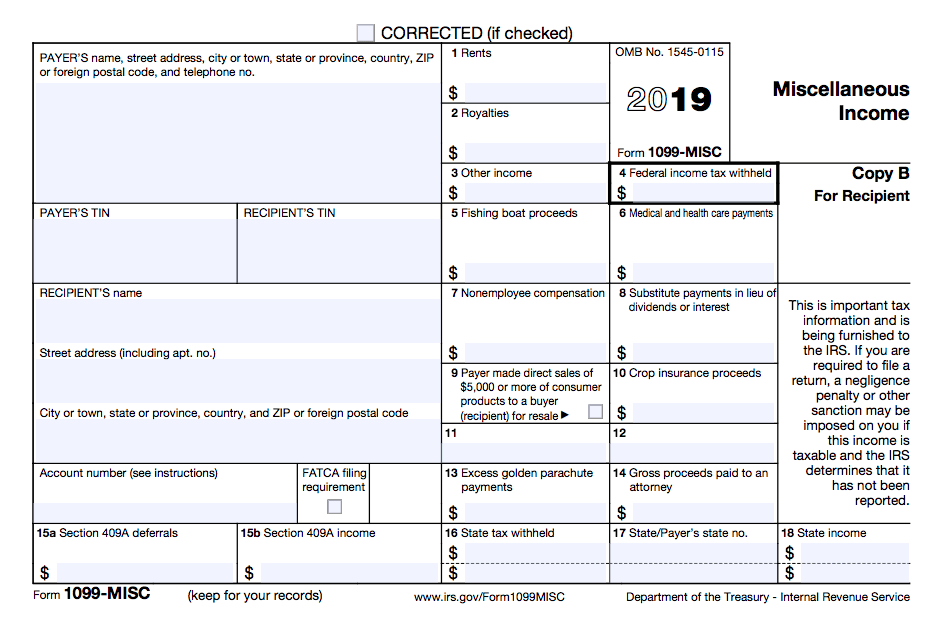

Changes in the reporting of income and the forms box numbers are listed below. Wage Tax Forms Form W-2 Form W-2c Form W-2PR W-2 State Filings. Missouri Department of Revenue Taxation Division PO.

PA Department of Revenue. 3 rows Mailing Address for IRS Form 1099-MISC. But in order to send electronically the recipient must consent to receiving the form electronically.

For tax year 2020 or a prior year entities or people who have paid you money during the year but who are not your employer will mail you a 1099-MISC form for. 1099 Forms Form 1099 NEC Form 1099 MISC Form 1099 INT Form 1099 DIV Form 1099 R Form 1099 S Form 1099 B Form 1099 K Form 1099 C Form 1099 G Form 1099 PATR Form 1099 Corrections 1099 State Filings Form 1098-T. Its critical to follow the steps below for fixing incorrectly filed forms.

But the instructions for Form 1096 say. To do this fill out a new Form 1099-MISC and enter an X in the CORRECTED box at the top of the form. The form doesnt replace Form 1099-MISC.

13 hours ago1099-MISC and 1099-NEC. Bureau of Individual Taxes. If you have 250 or more income statements you must use MTO to electronically send a magnetic media formatted file.

If you cannot get this form corrected attach an explanation to your tax return and report your income correctly. It just separates payments made to non-employees onto this different form for reporting purposes. Many companies choose to e-deliver 1099 forms to their recipients either through their platform or through email.

Report rents from real estate on Schedule E Form 1040. The IRS acts as a forwarding agent only so it is your responsibility to contact your state to verify that they have received the form and to find if they need additional information. Payer made direct sales of 5000 or more checkbox in box 7.

So which is it. Due to the creation of Form 1099-NEC we have revised Form 1099-MISC and rearranged box numbers for reporting certain income. In addition use Form 1099-MISC to report that you made direct sales of at least 5000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

Crop insurance proceeds are reported in. Updated on December 29 2020 - 1030 AM by Admin. Box 3330 Jefferson City MO 65105-3330.

Forms W-2 W-2C W-2G 1099-R 1099-MISC and 1099-NEC may be filed by magnetic media. How do I send magnetic media to the State of Michigan. If the entity is issuing 9 or fewer paper 1099R with a premature distribution of a pension or profit-sharing plan or a 1099 MISCNEC that has zero PA withholdings the forms should be mailed to.

What Is 1099 Misc Form How To File It Complete Guide

What Is 1099 Misc Form How To File It Complete Guide

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

1099 Misc Form 3 Part E File Self Mailer Discount Tax Forms

1099 Misc Form 3 Part E File Self Mailer Discount Tax Forms

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Software To Create Print E File Irs Form 1099 Misc

1099 Misc Software To Create Print E File Irs Form 1099 Misc

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

How Do You File 1099 Misc Wp1099

How Do You File 1099 Misc Wp1099

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Misc Form 5 Part Carbonless Discount Tax Forms

1099 Misc Form 5 Part Carbonless Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

What Is Irs Form 1099 Misc Smartasset

What Is Irs Form 1099 Misc Smartasset

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog