1099 Business Partner

Open the vendors list and select the vendor that you will be setting up as a 1099 vendor. Opens the Properties window in which you can set additional selection criteria based on business partner properties.

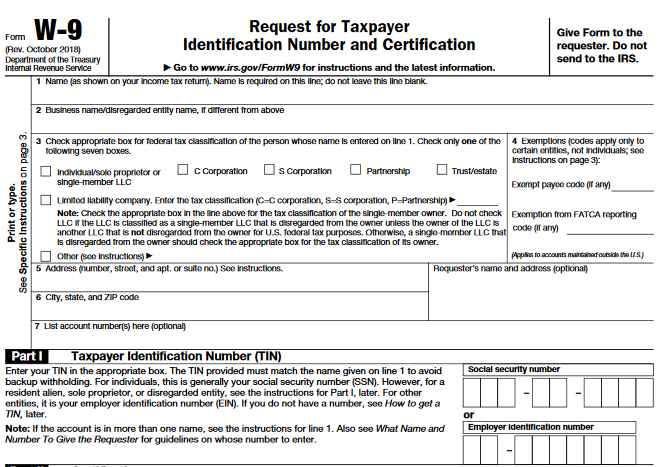

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

Within the Payments Fast tab select the IRS 1099 Code for the vendor and enter their Federal ID no.

1099 business partner. I would assume then that the ex-partner invested some money in the company originally or along the way. To set up a 1099 vendor. You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate.

A pship should not issue a 1099-MISC to a partner for services. For example if all income totals 1000. If youve hired an independent contractor to perform services for your company or business theres a high likelihood you need to report their.

1099 Forms Opens the 1099 Report Selection Criteria window where you can select the 1099 forms to be included in the selection criteria. How do I enter 1099 for business partnership. See the screen shot below.

A pship can issue a 1099-INT to a partner if that partner loans the pship funds in his capacity as a lender not a partner and the pship pays interest on that loan. Suppliers of merchandise telegrams telephone freight storage and similar items with the exception of those who deal in fish or other aquatic life. Can I report a 1099 k in a business partners name if my name is on the 1099.

You will both need the Self-employed Edition. However there are some instances in which you dont need to issue a 1099-MISC. Our partner Vensure Employer Services has created a quick chartinfographic for the forms employers need for a 1099 employee.

In Business Central a new 1099 Form Box code DIV-05 has been added and all the 1099 codes from DIV-05 to DIV-11 were upgraded to codes from DIV-06 to DIV-12. These forms include a 1099-MISC form W-9 and a written contract signed by both parties. Hi Readers This is a quick article about changes in IRS 1099 Form in Dynamics NAV and Business Central.

You can just add up the total income and report that as General Income based on each partys share. You generally issue a 1099-Misc for when youre paying someone for services rents royalties etc. If you change the 1099 code on the Vendor Card page a notification will display asking if you.

In this case the contractor is filing as an individual without a business structure. His tax treatment is. When you open the IRS 1099 Form Box page a notification pops up to upgrade the form boxes.

Partnerships or Multimember LLCs as they essentially file the same return as a partnership. Regulatory 1099 Format Changes December 2018. Sole proprietors may not operate as a business entity but the company might still file the 1099 for them.

You will complete a Schedule C based on each partners share. For example you say you bought out the ex-partner. Who are considered Vendors or Sub-Contractors.

Click the back arrow in the top left of the vendor card to save the change. If you are an independent contractor or business owner that provides services to others you are typically considered self-employed and therefore would receive a 1099 for your services. It is then up to the recipient to report the amounts on the 1099 appropriately and demonstrate any portion that should not be income on the tax return.

When you buy an asset from someone such as their book of business which is an intangible asset you generally do not issue a Form 1099-Misc. Report Inappropriate Content. 1099 Requirements for Limited Liability Partnerships Corporations limited liability companies and limited liability partnerships of all sizes generally use a number of.

You would need to originally include it on your own Schedule C and then expense it to him with an explanation. A 1099 form is typically intended for individuals to file when they provide services or goods to a company. Based on the information above you would enter 500 for yourself and 500 for yourself.

With latest cumulative update Microsoft have released update for North America version which includes a Application change related to IRS 1099 Form. As a general rule a business must issue a Form 1099-MISC to each individual partnership Limited Liability Company Limited Partnership or Estate to which you have paid at least 600 in rents or fees for services including parts and materials prizes and awards or other income payments.

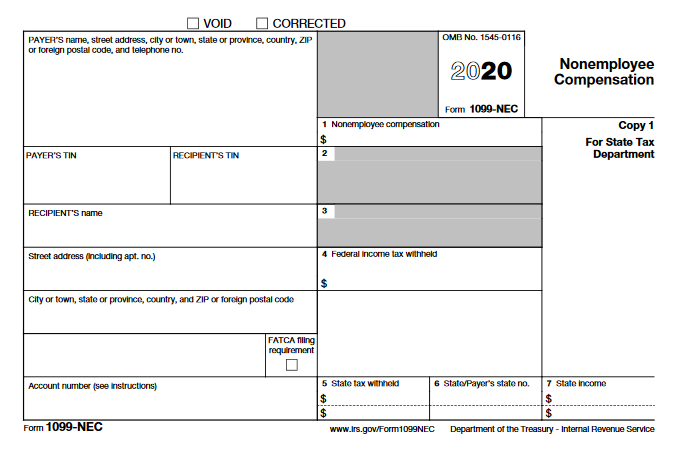

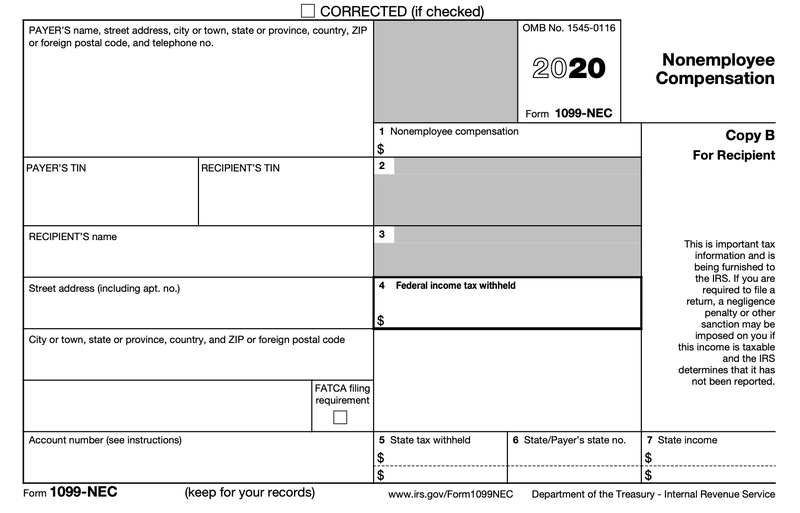

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

A 2021 Guide To Taxes For Independent Contractors The Blueprint

A 2021 Guide To Taxes For Independent Contractors The Blueprint

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Pay Contractors And Freelancers Clockify Blog

How To Pay Contractors And Freelancers Clockify Blog

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler