Business Interest Income For Form 8990

Prior year excess business interest expense generally must file Form 8990 unless an exclusion from filing applies. Go to the IncomeDeductions 8990 - Interest Expense Limitation worksheet.

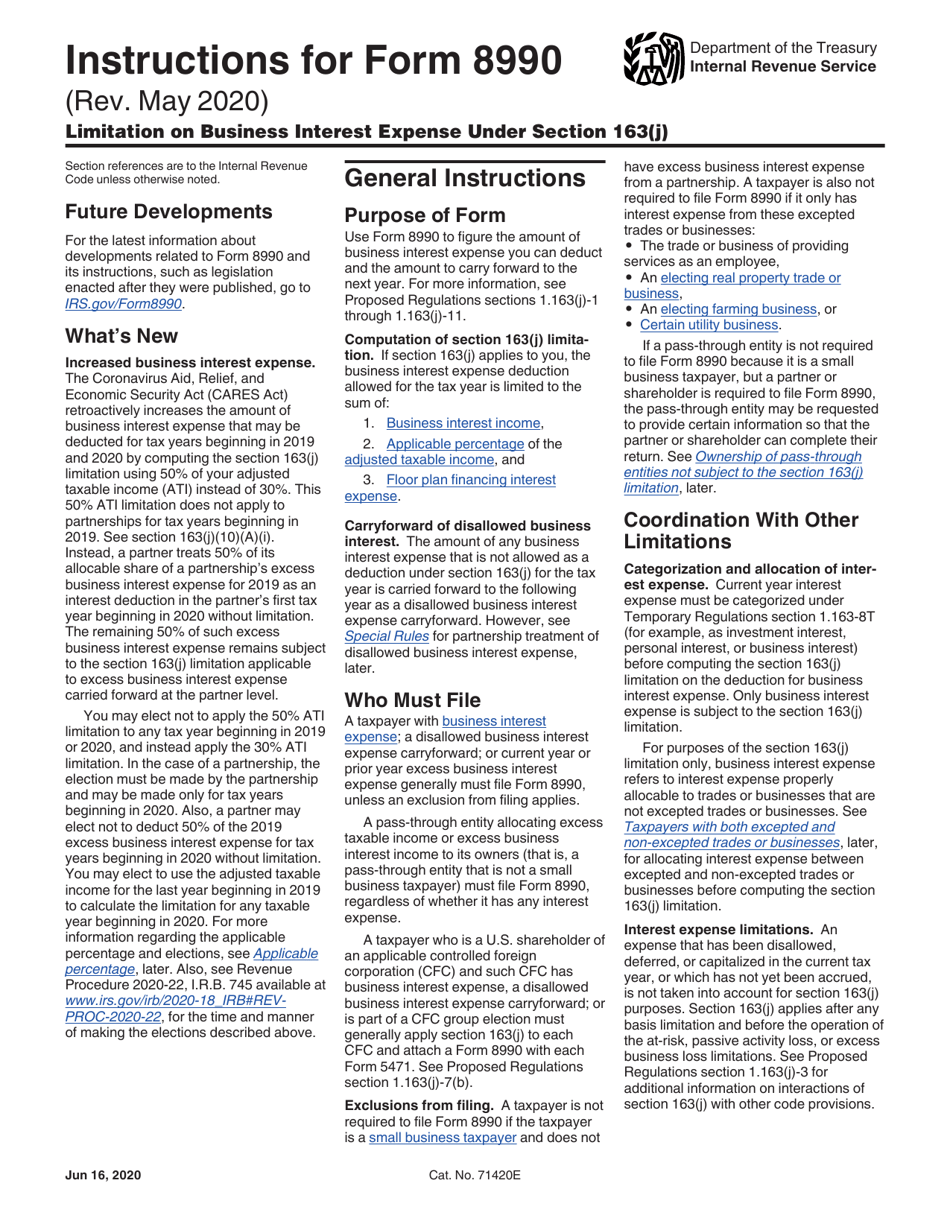

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

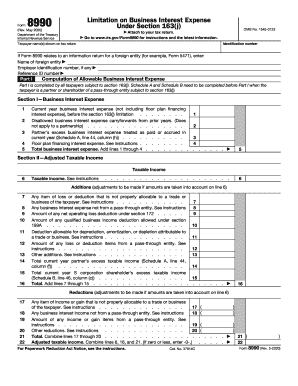

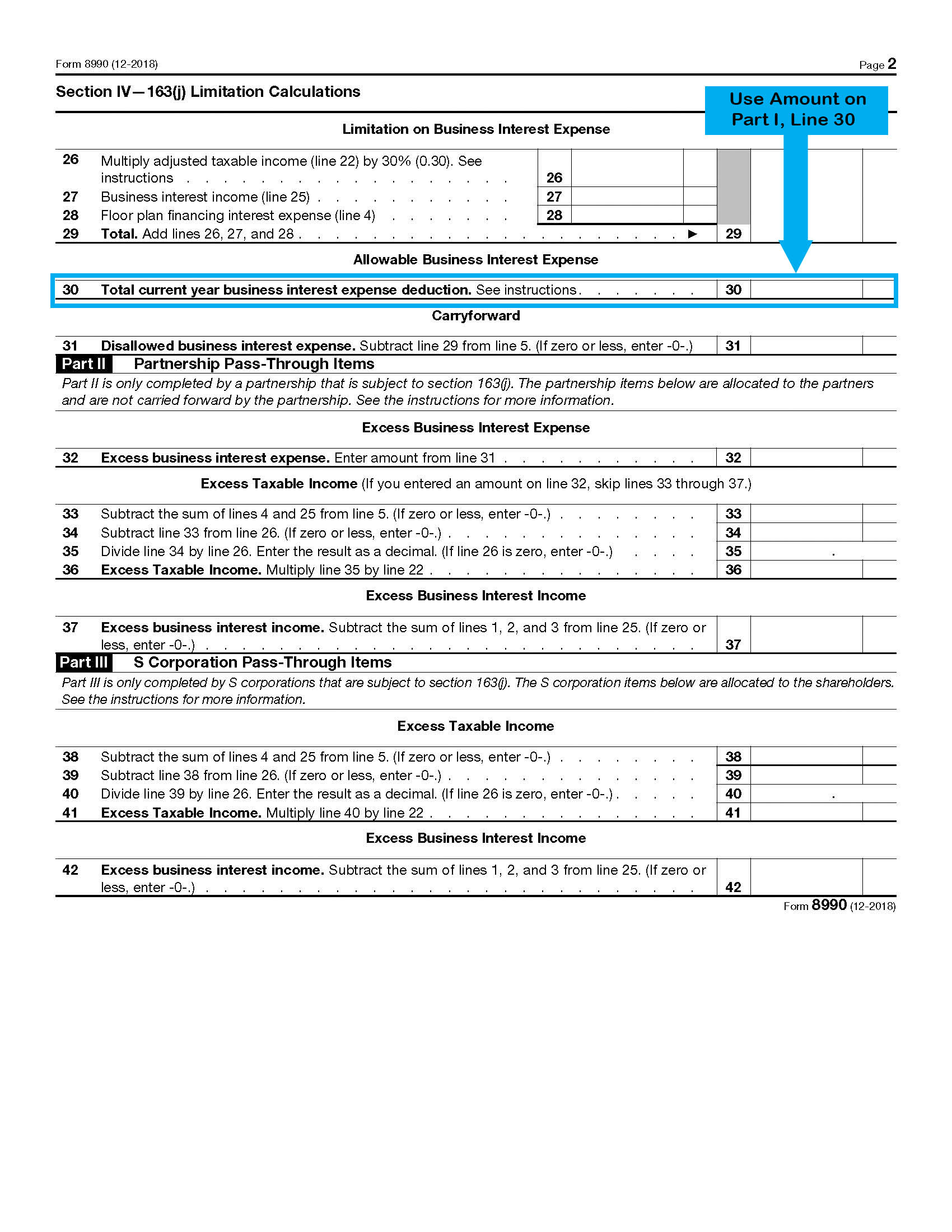

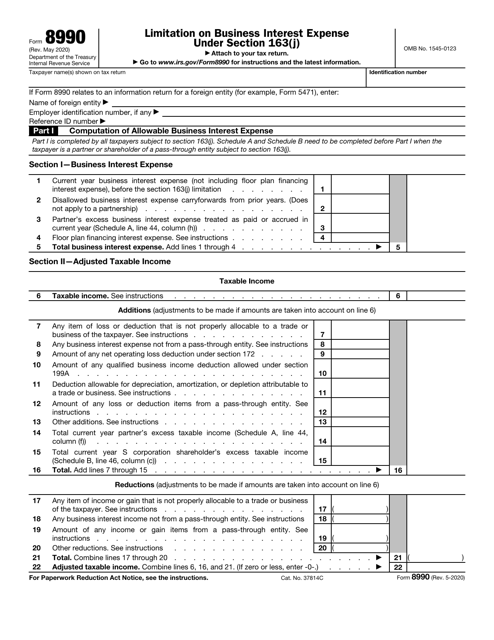

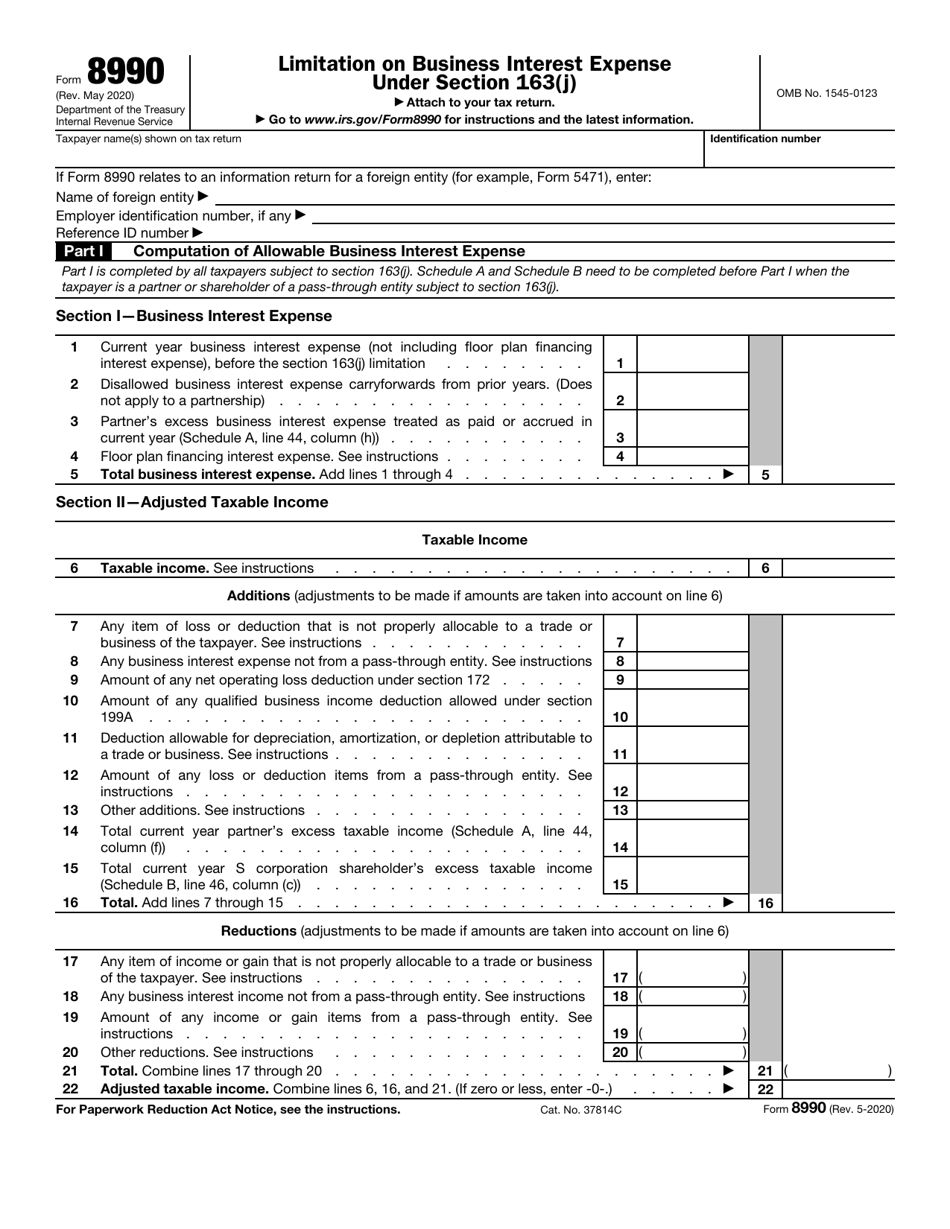

The form calculates the section 163 j limitation on business interest expense in coordination with other limits.

Business interest income for form 8990. For tax years beginning after December 31 2017 the deduction for business interest expense is generally limited to the sum of. May 2020 Department of the Treasury Internal Revenue Service. For instructions and the latest information.

Form 8990 is to figure the amount of business interest expense you can deduct and the amount to carryforward to the next year. If you have any carry forwards from last years Form 8990 those go on line 2 and the current year excess business interest goes on. Taxpayer names shown on tax return.

Select Section 1 - Form 8990 - Limitation of Business Interest Under Sec. Form 8990 The new section 163 j business interest expense deduction and carryover amounts are reported on Form 8990. Beginning in tax year 2018 Form 8990 Limitation on Business Interest Expense Under Section 163 j is available for use and filing in the 1040 1120 1120-S and 1065 return types.

Form 8990 Section III lines 23-25. The specific question goes to the point that the Taxpayer has received a Schedule K-1 1065 from a PTPMLP with entries on the K-1 possibly including on Line. Taxpayers can now elect to calculate the Adjusted Taxable Income ATI limitation at a rate of 50 or continue to calculate the limitation at the 30 rate.

Itemized list of where the business interest expense is being deducted Ctrl E code 18 - If the business interest expense is limited and is reported on more than one location on the tax return Form 8990 states that you must attach a schedule to Form 8990 which indicates the amount and line item on the tax return where the business interest expense is being deducted. In Line 21 - All taxpayer activities are subject to Section 163 j use the lookup value double-click or press F4 to. Business interest income 1 Thirty percent of adjusted taxable income ATI 2 Floor plan financing interest.

Per the IRS Form 8990 is used to calculate the amount of business interest expense that can be deducted and the amount to carry forward to the next year. In Part 1 line 1 youll take any other business interest expense you have reported on your other K-1s if you dont have any then that line will be zero. Use the Business interest expense subject to limitation field on Screen Inc Screen F-2 Screen 4835-2 and Screen Rent to indicate the portion of interest expense that qualifies as business interest.

Prior year excess business interest expense generally must file Form 8990 unless an exclusion from filing applies. Limitation on Business Interest Expense Under Section 163j Attach to your tax return. This information flows to an.

Form 8990s utility for a Personal Form 1040 is probably close to zero if not zero. Revenue Procedure 2020-22 provides as part of the CARES Act guidance for changes regarding Form 8990 Limitation on Business Interest Expense Under Section 163 j. This is in refernece to the 163j business interest limitation and Form 8990.

A pass-through entity allocating excess taxable income or excess business interest income to its owners that is a pass-through entity that is not a small business taxpayer must file Form 8990. Is there excess business interest and Adjusted taxable income on that K-1 too. The form calculates the section 163 j limitation on business interest expenses in coordination with other limits.

If section 163 j applies to you the business interest expense deduction allowed for the tax year is limited to the sum of. A taxpayers business interest income includes any business interest income directly paid to or accrued by the taxpayer as well as business interest income allocated from a pass-through entity not subject to the Code Sec. A pass-through entity allocating excess taxable income or excess business interest income to its owners that is a pass-through entity that is not a.

Refer to the Form 8990 instructions for more information on the filing requirements and calculations. Form 8990 The section 163 j business interest expense deduction and carryover amounts are reported on Form 8990. There you can also enter business interest expenses and income taxable income prior year gross receipts Partnership pass-through items and Schedule B information related to the calculation of Form 8990.

Level 1 12-07-2019 0401 AM. Ex-AllStar 0 Cheers Reply.

Https Www Irs Gov Pub Irs Prior F8990 2018 Pdf

Form 8990 Fill Out And Sign Printable Pdf Template Signnow

Form 8990 Fill Out And Sign Printable Pdf Template Signnow

Submission Taxpayer Submission

Submission Taxpayer Submission

Download Instructions For Irs Form 8990 Limitation On Business Interest Expense Under Section 163 J Pdf Templateroller

Download Instructions For Irs Form 8990 Limitation On Business Interest Expense Under Section 163 J Pdf Templateroller

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 5471 01 2021 Internal Revenue Service

Instructions For Form 5471 01 2021 Internal Revenue Service

100 Day Planning Template Beautiful Free 11 100 Day Plan Templates In Pdf 100 Day Plan Business Plan Template Free Executive Summary Template

100 Day Planning Template Beautiful Free 11 100 Day Plan Templates In Pdf 100 Day Plan Business Plan Template Free Executive Summary Template

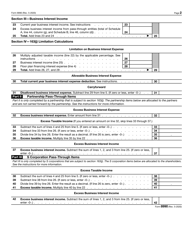

Irs Form 8990 Download Fillable Pdf Or Fill Online Limitation On Business Interest Expense Under Section 163 J Templateroller

Irs Form 8990 Download Fillable Pdf Or Fill Online Limitation On Business Interest Expense Under Section 163 J Templateroller

Irs Form 8990 Download Fillable Pdf Or Fill Online Limitation On Business Interest Expense Under Section 163 J Templateroller

Irs Form 8990 Download Fillable Pdf Or Fill Online Limitation On Business Interest Expense Under Section 163 J Templateroller

Glen Birnbaum On Twitter Taxtwitter Draft Form 8990 Released Last Week New Business Interest Limitation Rules Anyone Hearing When 163 J Proposed Regs Will Be Coming Out Https T Co Zfdztp3mmg Https T Co Ko23l0fowd

Glen Birnbaum On Twitter Taxtwitter Draft Form 8990 Released Last Week New Business Interest Limitation Rules Anyone Hearing When 163 J Proposed Regs Will Be Coming Out Https T Co Zfdztp3mmg Https T Co Ko23l0fowd

Submission Taxpayer Submission

Submission Taxpayer Submission

Weekly Cleaning Schedule A Pretty Free Printable Maeryan Weekly Cleaning Cleaning Schedule Weekly Cleaning Schedule

Weekly Cleaning Schedule A Pretty Free Printable Maeryan Weekly Cleaning Cleaning Schedule Weekly Cleaning Schedule

Irs Form 8990 Download Fillable Pdf Or Fill Online Limitation On Business Interest Expense Under Section 163 J Templateroller

Irs Form 8990 Download Fillable Pdf Or Fill Online Limitation On Business Interest Expense Under Section 163 J Templateroller

Irs Form 8990 Download Fillable Pdf Or Fill Online Limitation On Business Interest Expense Under Section 163 J Templateroller

Irs Form 8990 Download Fillable Pdf Or Fill Online Limitation On Business Interest Expense Under Section 163 J Templateroller

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

Https Www Irs Gov Pub Irs Prior I8990 2018 Pdf