Do You Have To Pay Back Covid 19 Small Business Grant

An employer can give up to 10 weeks of paid family leave at two-thirds their regular pay for up to 200 per day and 10000 total if the employee is unable to work or telework because theyre caring for a child whose. School or place of care is closed due to COVID-19.

How To Get An Sba Disaster Loan Eidl Bench Accounting

How To Get An Sba Disaster Loan Eidl Bench Accounting

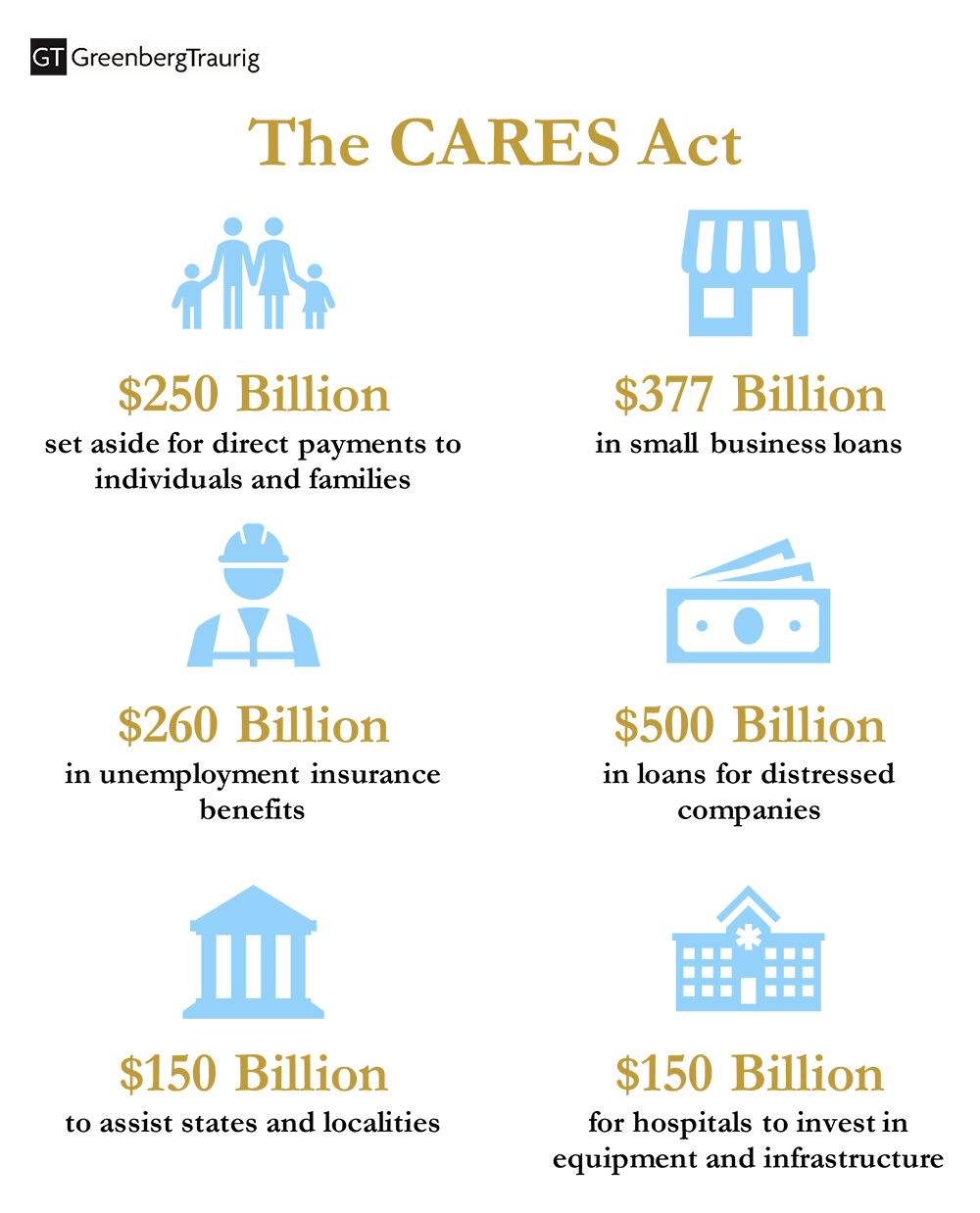

Apr 04 2020 The PPP authorizes up to 349 billion in forgivable loans to small businesses to prevent more layoffs and allow companies keep their employees on the payroll during the COVID-19 pandemic.

Do you have to pay back covid 19 small business grant. The EIDL can give business owners fast relief through emergency grants up to 10000 that do not have to be paid back. Mar 01 2021 Small business grants for COVID-19 are essentially free money given to small business owners to help them survive the impacts of COVID-19. May 10 2020 Facebook is offering 100 million in grant funds and ad credits to small businesses affected by coronavirus.

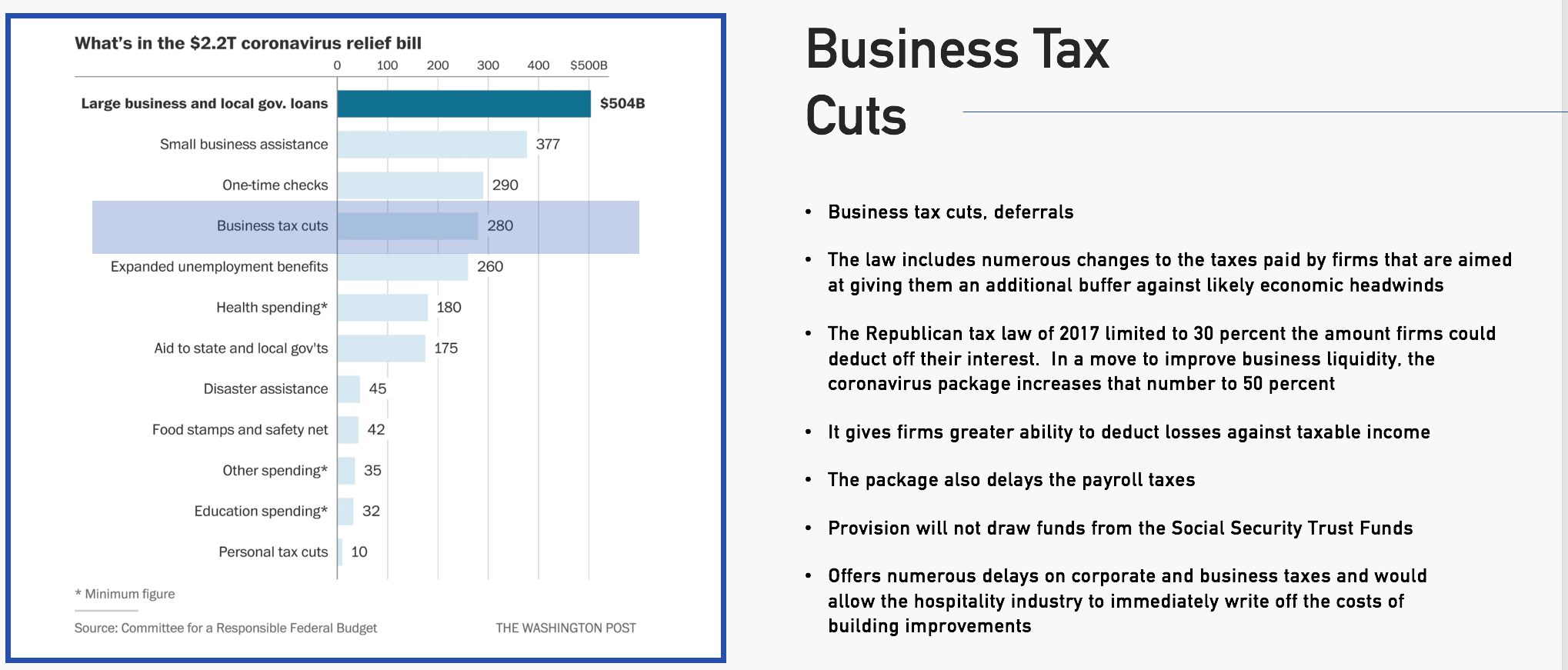

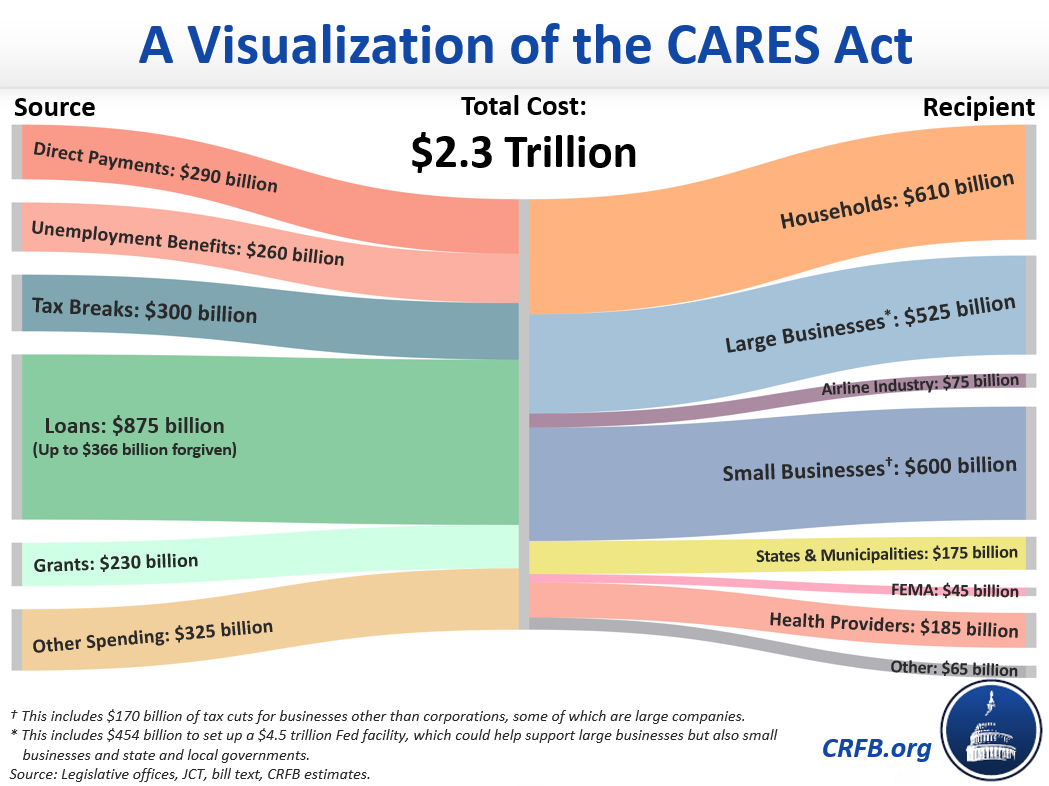

Paycheck Protection Program loans. Any of the information they submit is untrue. Aug 10 2020 The governments coronavirus economic support includes paid sick leave an employee retention tax credit a tax deadline extension and many other forms of aid for individuals and businesses.

Jan 15 2021 The grant first announced in December provides a minimum of 10000 to a maximum of 20000 to eligible small businesses who have had to restrict their operations due to the Provincewide Shutdown. EIDL is a direct loan for up at a rate of 375 for small businesses and 275 for nonprofits. Unlike a loan grants arent paid back but they often have strict restrictions on how you can spend them.

While additional funding has been allocated to the COVID-19 Emergency Relief Grant Fund we are not accepting new grant applications and will continue to distribute funds on a first-come first-served basis based on the applications we have. Apr 23 2020 Under the CARES Act passed on March 27 2020 independent contractors small businesses gig workers and freelancers are eligible to receive a government grant of up to 10000. This grant will need to be included as income in the tax return of the business.

SBA is currently offering the following funding options. Mar 24 2020 Coronavirus COVID-19. Allowable costs incurred by recipient grants staff performing grant duties while teleworking would be permissible due to COVID-19.

The tightened restrictions were put in place to help stop the alarming rise of COVID-19 cases in Ontario. From 20 March to 30 June 2020 VAT payments for all UK businesses were deferred automatically as a result of COVID-19. If you have not received a PPP loan before.

You may use the loan for payroll rent or mortgage other debt or paid sick leave. 200403-405 in accordance with the Uniform Administrative Requirements Cost Principles and Audit Requirements for HHS Awards 45 CFR Part 75 and consistent with the recipients organizational policies and procedures. To qualify businesses need to have between 2 and 50 employees.

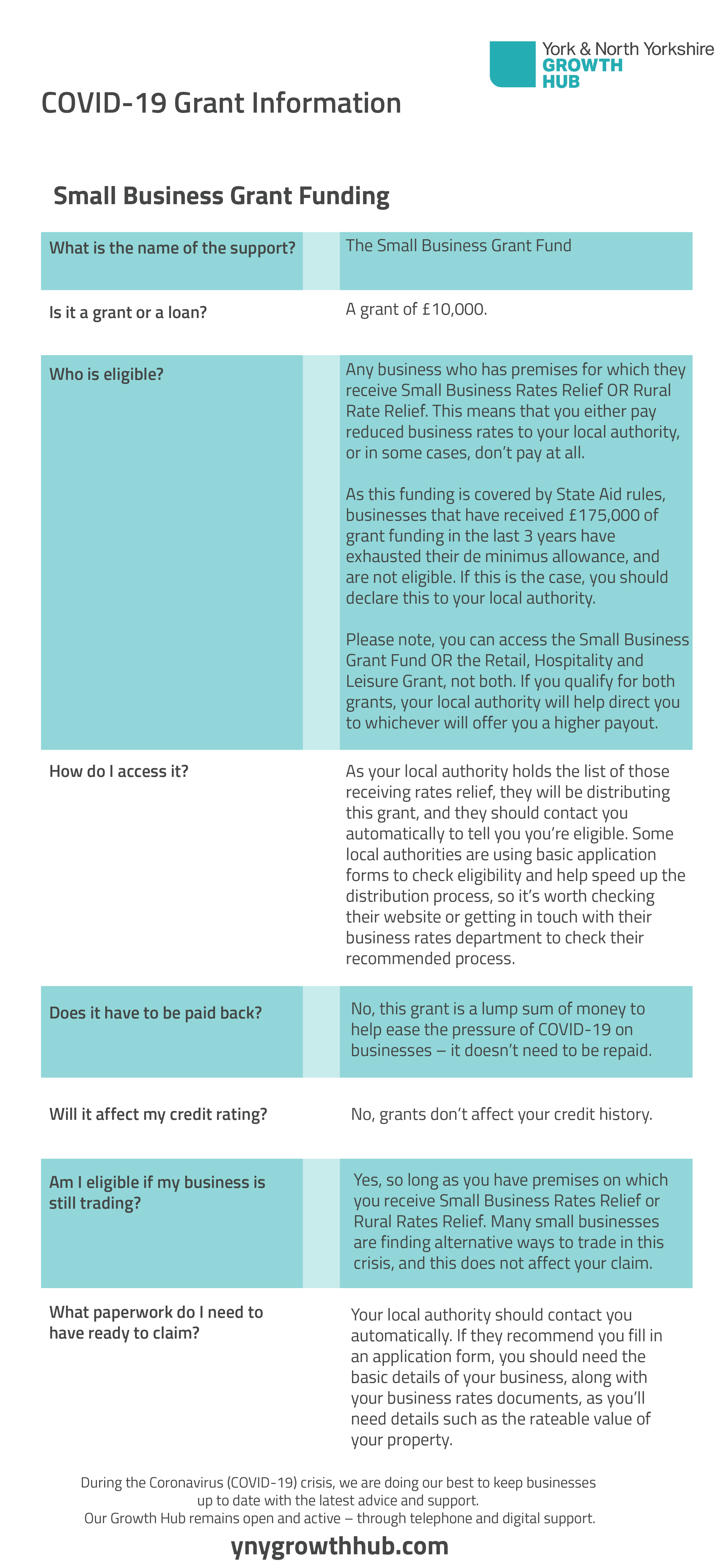

Business support grant funding - guidance for local authorities Guidance for local authorities setting out details of the Small Business Grants Fund SBGF and Retail. First Draw PPP loans. If your small business is losing revenue due to the COVID-19 pandemic you may be eligible for up to 10000 in emergency economic relief.

If youre based in Northern Ireland and you pay your business rates by Direct Debit youll receive the grant automatically. SBA offers several relief options to help businesses nonprofits and faith-based organizations recover from the impacts of COVID-19. The grant and tourism top-up are subject to your business meeting the eligibility criteria and developing a recovery plan that youll be able to complete.

Mar 09 2020 NOTE. Starting the week of April 6 2021 the SBA is raising the loan limit for the COVID-19 EIDL program from 6-months of economic injury with a maximum loan amount of 150000 to up to 24-months of economic injury with a maximum loan amount of 500000. Review all options or skip to a specific program in the information that follows.

But you dont have to be a traditional company and this. To qualify businesses. A business will only need to pay back the funding if.

But as you manage your business dont forget about yourself and the possibility that youll receive a COVID-19 stimulus check. This grant doesnt need to be repaid and you can claim the grant and continue to do business. As of October 22 Governor Hogan has announced a new 250 million relief package for businesses throughout Maryland.

In response to COVID 19 local authorities are providing 10000 from the Small Business Grant Fund SBGF which the BEIS FAQ says is taxable. For business who deferred their VAT bills during this time you will have more time to pay through the New Payment Scheme which also has means you can pay back in smaller instalments. Childcare provider is unavailable due to COVID-19.

Only businesses which make an overall profit once grant income is included will be subject to tax. If your business is in England Scotland or Wales you should apply to your local authority for the grant. Apr 02 2020 The Small Business Administration says its ready to make immediate loan advances of up to 10000 to companies hurt by the coronavirus.

Mar 11 2020 COVID 19 and Small Business Grant Fund. Small business owners can apply for a larger EIDL loan but the first 10000 is a grant that does not need to be paid back.

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Covid 19 Information For Businesses Clackamas County

Covid 19 Information For Businesses Clackamas County

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Covid 19 Information For Businesses Clackamas County

Covid 19 Information For Businesses Clackamas County

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Resources Congressman Thomas Suozzi

Coronavirus Resources Congressman Thomas Suozzi

Covid 19 Information For Delaware Small Businesses Division Of Small Business State Of Delaware

Covid 19 Information For Delaware Small Businesses Division Of Small Business State Of Delaware

How To Fill Out The Sba Disaster Loan Application Youtube

How To Fill Out The Sba Disaster Loan Application Youtube

Business Resources For Covid 19 Concerns Grand Island Ne Giaedc

Business Resources For Covid 19 Concerns Grand Island Ne Giaedc

Quick Guide Small Business Grant Funding Y Ny Growth Hub

Quick Guide Small Business Grant Funding Y Ny Growth Hub

Center For Nonprofits Covid 19

Center For Nonprofits Covid 19

10 Covid 19 Grants For Individuals Grants

10 Covid 19 Grants For Individuals Grants

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Congress Passes Cares Act Overview Of The Relief Available To Small And Other Business Concerns Insights Greenberg Traurig Llp

Congress Passes Cares Act Overview Of The Relief Available To Small And Other Business Concerns Insights Greenberg Traurig Llp

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

List Of Coronavirus Covid 19 Small Business Loan And Grant Programs

List Of Coronavirus Covid 19 Small Business Loan And Grant Programs

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation