Does A Law Firm Get A 1099

Moreover any client paying a law firm more than 600 in a year as part of the. What Types of Payments to Attorneys.

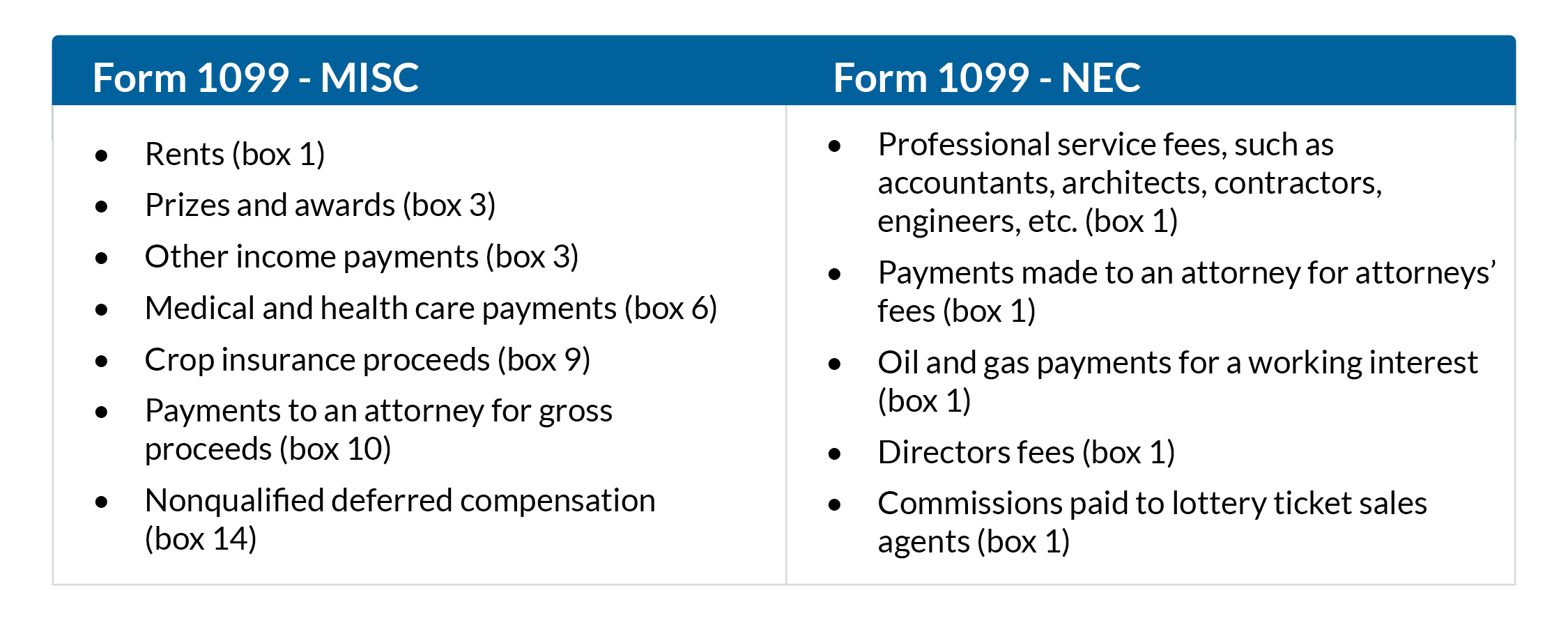

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Attorneys fees of 600 or more paid in the course of your trade or business are reportable in box 7 of Form 1099-MISC under section 6041A a 1.

Does a law firm get a 1099. 1099-MISCs are issued for payment of attorney fees even for corporations Any gross proceeds paid to an attorney typically for claim settlements Any payments made to for-profit medical care providers. A company may need to file a 1099-MISC for funds it pays a PLLC if it meets one of the IRS requirements to receive a form. Plus any client paying a law firm more than 600 in a year as part of the clients business must issue a Form 1099.

As a general rule a business doesnt need to issue a 1099 to a corporation or an LLC organized as a corporation. 1099-MISCs are applicable for services not for merchandise or goods purchased. Under section 6045 f report in box 14 payments that.

One of them is 1099 reporting. In general you will use Form 1099-NEC if. A lawyer or law fi rm paying fees to co-counsel or a referral.

It does not matter if the law fi rm is a corporation LLC LLP or general partnership. Th is impacts law fi rms as issuers of Forms 1099 as well as receiving them. Any amount of money paid to attorneys organized as PLLC or any other corporate structure must be reported to the IRS on a 1099-MISC in box 14.

Lawyer or law fi rm must be the subject of a Form 1099. Sole proprietorships and partnerships have to get a 1099 whenever they do 600 or more. Corporations and LLCs treated as an association and taxed as a corporation are generally not issued 1099-MISCs.

Most settlements are taxable unless the award was for a physical injury or illness. As year-end approaches the typical law firm CFO has 1099 things to do. However a reporting entity must also file a Form 1099-MISC for payments to all attorneys even if the attorneys law practice is incorporated.

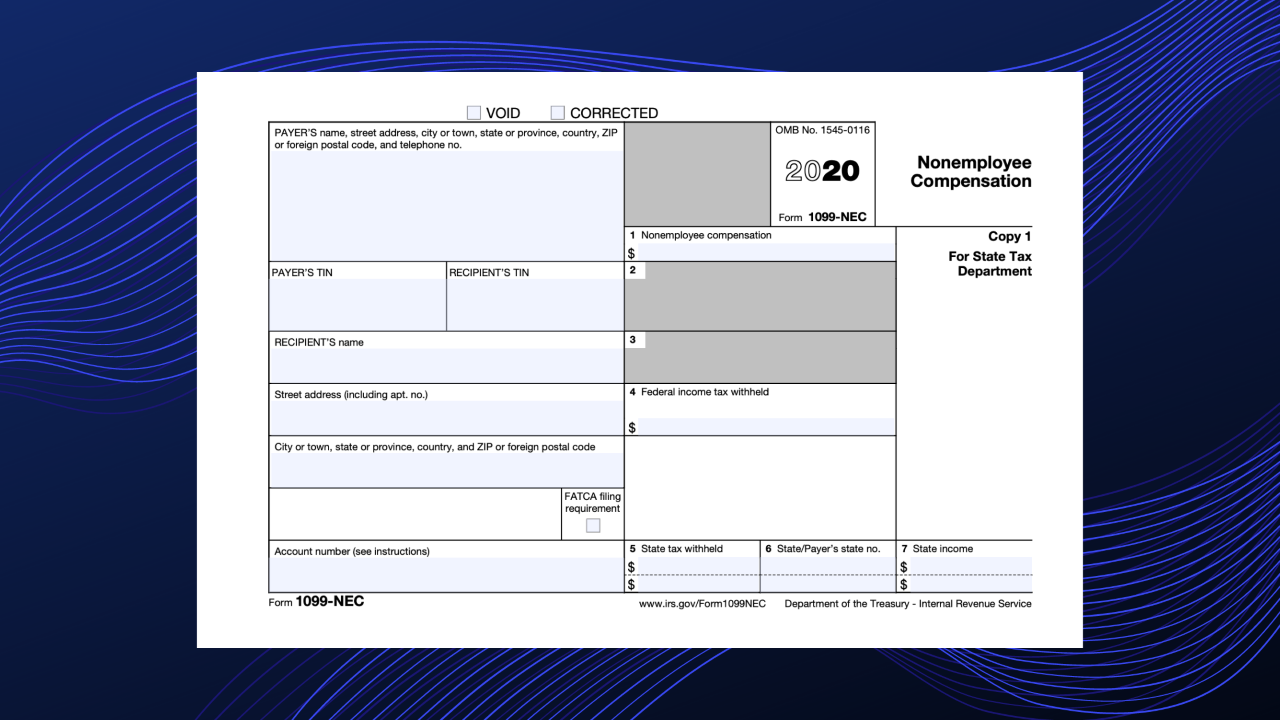

If your business paid an independent contractor 600 or more during 2020 for services you are required to prepare and file Form 1099-NEC and to provide a copy of the form to the independent contractor. The size of the law firm also doesnt matter. A Form 1099-MISC for certain payments made in the course of its trade or business to another person or a noncorporate business entity in any calendar year.

Gross proceeds paid to attorneys. 1099-MISCs are issued to individuals estates partnerships single-member LLCs and LLCs treated as partnerships. A lawyer or law firm paying fees to co-counsel or a referral fee to a lawyer must issue a Form 1099 regardless of how the lawyer or law firm is organized.

If you win a settlement in a lawsuit the person or business that pays out the settlement or that person or businesss insurance company is required to send you a 1099 if the settlement is taxable. You paid someone who is not an employee for services related to your trade or business. There are a few exceptions to that rule however.

Generally speaking a business is not required to file a 1099 regarding contractors to. But someone has to do itjust too bad it has to be you. It might have one lawyer or thousands.

It also means any client paying an incorporated law firm more than 600 in a year must issue a Form 1099. Forms 1099 are generally issued in January of the year after payment. The business serves as the issuer of the Form 1099 and uses it as a means of showing expenses to the IRS while the contractor is the payee using the form as a means of demonstrating their taxable income.

The term attorney includes a law firm or other provider of legal services. When your business mails out 1099-MISC forms at the end of the tax year you dont send them to corporations. According to the IRS 1099 instructions attorney fees for legal services must be reported on a Form 1099 regardless of whether the law firm or legal service is incorporated or not.

It also does not matter how large or small the law fi rm. If this is the first time youve been assigned 1099 duty you will likely find the process to be solitary confusing and like most things with a deadline needing to be completed ASAP. A lawyer or law firm paying fees to co-counsel or a referral fee to a lawyer must issue a Form 1099 regardless of how the lawyer or law firm is organized.

Are made to an attorney in the course of your trade or business in connection with legal services but not for the attorneys. This affects law firms as issuers of Forms 1099 as well as receivers of them. So a lawyer or law firm paying fees to incorporated co-counsel or a referral fee to an incorporated lawyer must issue a Form 1099.

If you are a lawyer even an incorporated one you will receive many Forms 1099 from clients.

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Is Your Business Prepared For Form 1099 Changes Rkl Llp

Is Your Business Prepared For Form 1099 Changes Rkl Llp

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Ready For The 1099 Nec White Nelson Diehl Evans Cpas

Ready For The 1099 Nec White Nelson Diehl Evans Cpas

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

The Impact Of Irs Form 1099 Rules On Lawyers And Clients New York State Bar Association

The Impact Of Irs Form 1099 Rules On Lawyers And Clients New York State Bar Association

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Form 1099 Nec Non Employee Compensation Replaces 1099 Misc For Reporting Payments To Non Employees S J Gorowitz Accounting Tax Services P C

Form 1099 Nec Non Employee Compensation Replaces 1099 Misc For Reporting Payments To Non Employees S J Gorowitz Accounting Tax Services P C

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile