How Do I Register My Business With Tax Sars

Choose the correct user from Taxpayer List. Once you receive your tax registration number you can register to file your tax returns online using the SARS eFiling system.

Faq How Do I Get To The Income Tax Work Page To See My Income Tax Return Itr12

Faq How Do I Get To The Income Tax Work Page To See My Income Tax Return Itr12

7 of taxable income above 78 150.

How do i register my business with tax sars. Registering as an Employer. Hiring Freelances Independant Contractors. To complete the registration process you will need at hand.

The first step is to register your company at the CIPC with one of our consultants. Complete the EMP101e Payroll taxes - Application for Registration taxes form. Get started by logging in.

Your tax registration numbers. How do I register my small business for tax. Taxable income R Rate of tax R 0 75 750.

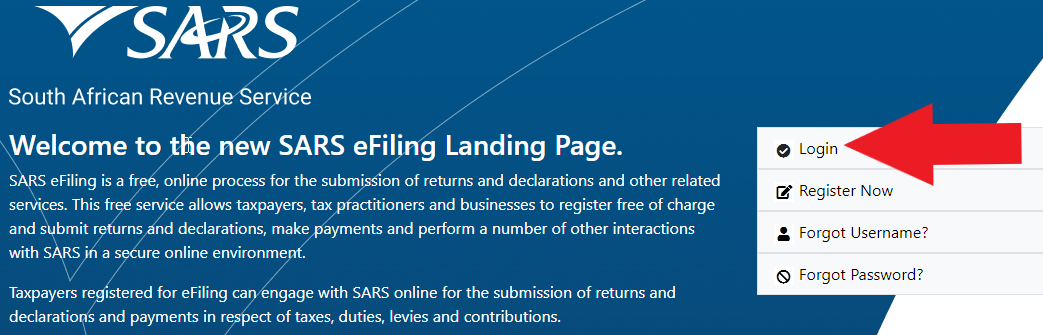

You can apply here. Once youre on the site simply click Register Now to get started. Click Organisation Tax.

Posted 10 June 2014 under Tax QA How do I register my small business for tax. Consult the Annual Notice to furnish returns issued by SARS to determine whether you need to register. Register as taxpayer You must register as a taxpayer with the South African Revenue Service SARS if you earn more than a specific amount which is determined every year.

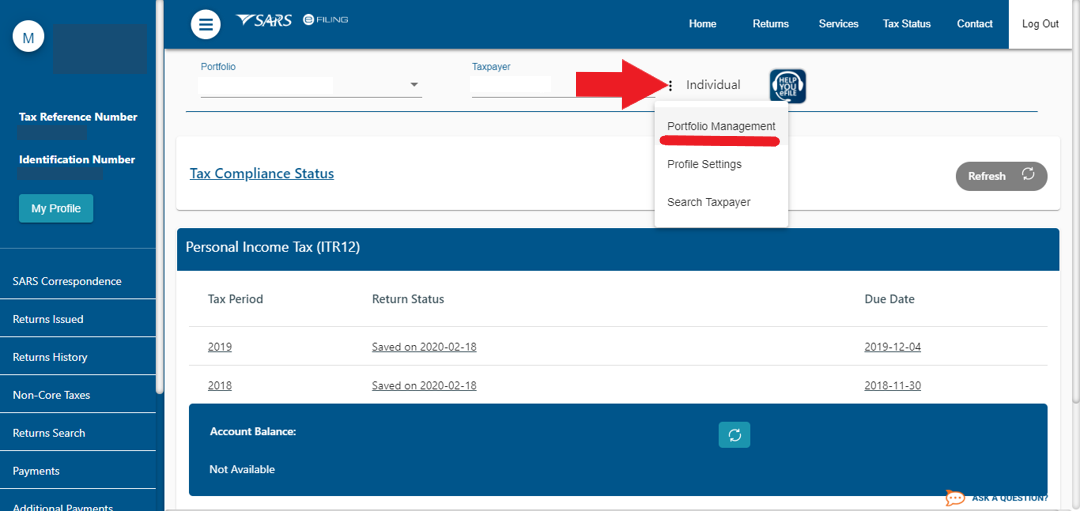

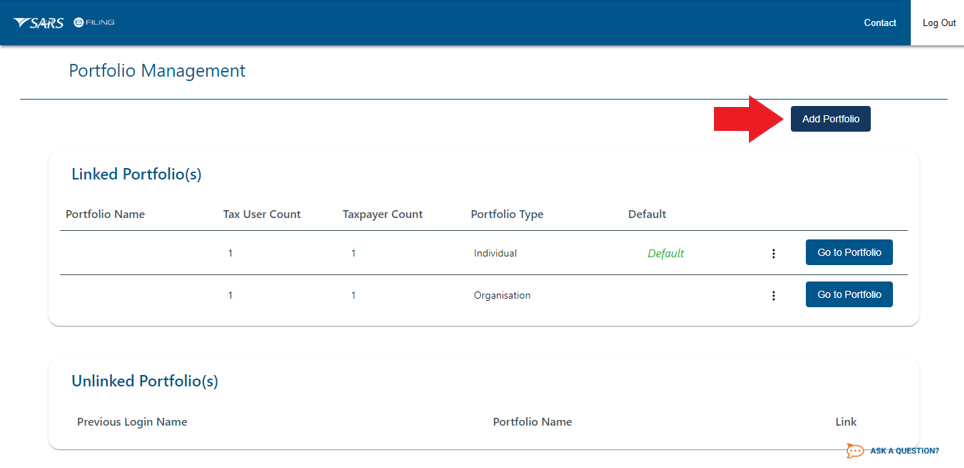

How to set up SARS eFiling for Business. For more information on Employees tax see the. Well show you how to register a company profile on eFiling.

20 080 21 of taxable income above 365 000. How to register for a SARS tax number Posted on 19 October 2019 by RegisterAdmin A look at the steps youd need to follow in order to register for a SARS tax number. An identification document such as an ID passport or drivers license.

Going to the Portfolio. For assistance in completing the form see the Guide for completion of Employer Registration application. SARS will send you a notification was the registration has been finalised or if they require additional documents to finalise the registration.

What Documents Do I Need To Apply For A Tax Number At SARS. Buying immovable property from a non-resident seller If you are buying South African immovable property from a non-resident seller you must complete form NR02 and an IRP63 using the sellers income tax reference number and withhold the tax. 365 001 550 000.

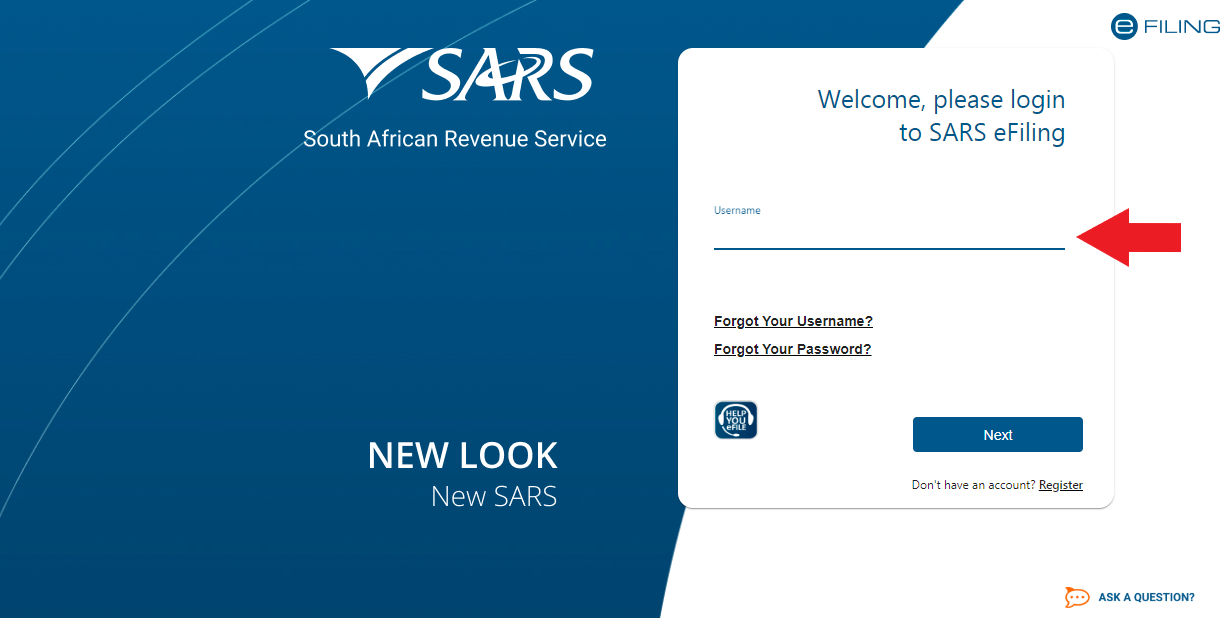

You can register once for all different tax types using the client information system. All you need is internet access. REGISTER FOR SARS EFILINGLONG AWAITED EASY 3 STEP PROCESSAvoid the lines to SARS and do it right the first timeI take you step by step to log into e-filing.

Complete the registration form click on Done and then on File. 550 001 and above. You are required to register with your local SARS office to obtain an income tax reference number within 60 days after you have commenced business.

If not you can register for an eFiling profile on the eFiling website. You must however first register for eFiling on the SARS eFiling website or using the MobiApp. Alternatively you can do this via MobiApp which can be downloaded on the Play Store or App Store.

You must register within 60 days of first receiving an income. This step assumes that you have registered. The easiest way to register with SARS is to visit the eFiling website.

Filing Taxes Online SARS eFiling System in South Africa. General disclaimerThese tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax Acts administered by the C. If a company is registered at CIPC it needs to be registered for Company Income Tax at SARS.

Financial years ending on any date between 1 April 2017 and 31 March 2018. EFilers will register as Please select and click on the appropriate option below. Once youre registered SARS will automatically issue you with a tax reference number.

After registration a Tax Consultant in your area will assist you with ALL the Tax Services you may require at very reasonable prices. We have a page where we explain to you in detail how to register for eFiling. EFiling is convenient option allows you to.

Click on Payroll taxes under My tax products and then click on Add new product registration. Below is a list of documents needed to register as a taxpayer in SA or change your registered particulars. How to register for PAYE on eFiling.

58 930 28 of the amount above 550 000. The easiest and quickest way to file a tax return is online by making use of SARS eFiling or the MobiApp. For CIPC registered companies you are not required to perform a separate SARS tax registration for Income Tax as your company will automatically be registered via a direct interface with CIPC.

An individual if they are operating in their personal capacity. Get SARS Tax Deadlines in your Inbox Well tell you when you need to file along with tax tips and updates. Every business liable to taxation under the Income Tax Act 1962 is required to register with SARS as a taxpayer.

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Sars Efiling How To Submit Your Itr12 Youtube

Sars Efiling How To Submit Your Itr12 Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register For Paye On Efiling

How To Register For Paye On Efiling

Tax Clearance Certificate New Compliance Pin With Sars Youtube

Tax Clearance Certificate New Compliance Pin With Sars Youtube

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling

Sars Efiling How To Register Youtube

Sars Efiling How To Register Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

Register On Sars Efiling Business Tax Types Youtube

Register On Sars Efiling Business Tax Types Youtube

Sars Organisation Option How To Add Your Business On Efiling Youtube

Sars Organisation Option How To Add Your Business On Efiling Youtube

How To Update Your Sars Registered Details On Sars Efiling Youtube

How To Update Your Sars Registered Details On Sars Efiling Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

How To Access My Compliance Profile

How To Access My Compliance Profile

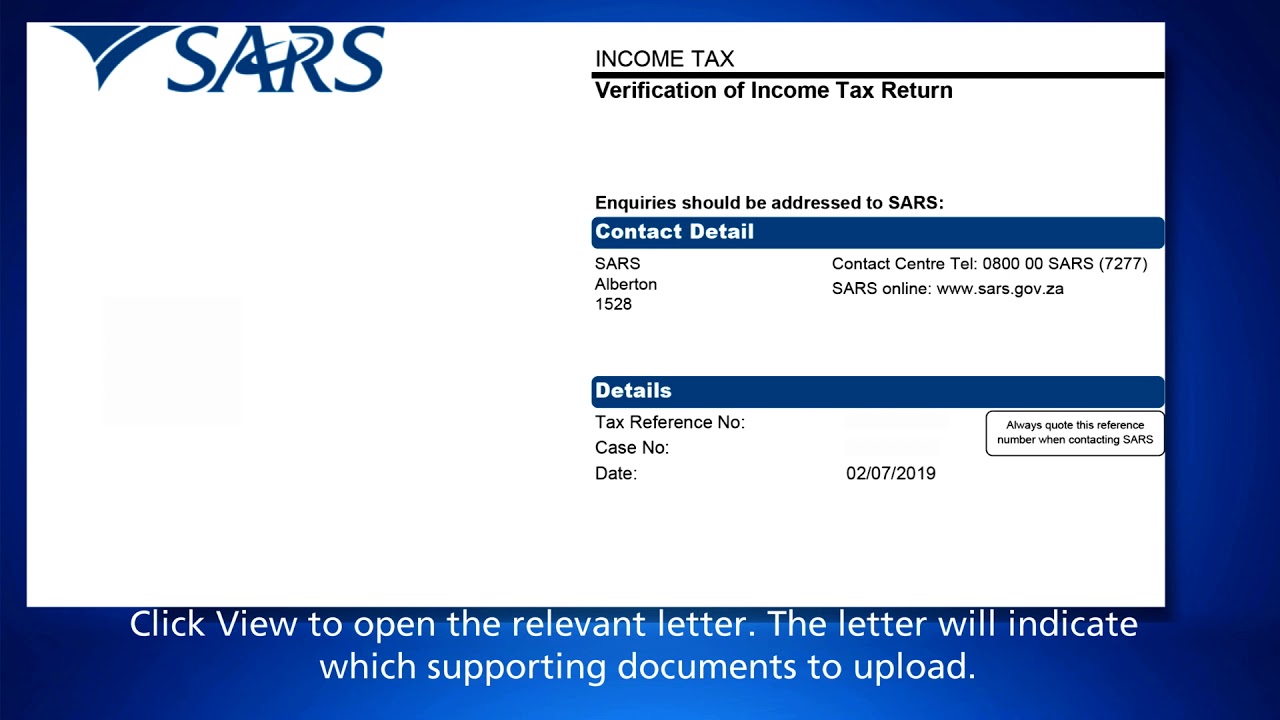

Sars Efiling How To Submit Documents Youtube

Sars Efiling How To Submit Documents Youtube