How To Get My 1099 Sa Form Online

You can elect to be removed from the next years mailing by signing up for email notification. This will take you to the Tell us about the health-related accounts you had in.

The distribution may have been paid directly to a medical service provider or to the account holder.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png)

How to get my 1099 sa form online. Log in to your account. Distributions From an HSA Archer MSA or Medicare Advantage MSA The financial institution that manages the account is responsible for sending you a copy of Form 1099-SA. You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

Tax forms are not available via the. Resources for filing IRS Form 8889. Hours of operation are 7 am.

File Form 1099-SA to report distributions made from a. If you want to change your address in TurboTax please follow these steps. Scroll down to Mailing Address and click on Edit.

2020 Form 1099-SA Distributions from an HSA 123-456789 --0000 1 of 2 Federal ID Number. This will help save taxpayer dollars and allow you to do a small part in saving. All tax statements will be mailed by January 31.

If you dont already have an account you can create one online. Sign in to your account and click the link for Replacement Documents. A replacement SSA-1099 or SSA-1042S is.

Log into TurboTax and click on any topic to continue. Employers who file Form 941 Employers QUARTERLY Federal Tax Return must file the revised form with COVID-19 changes from Quarter 2 of 2020. You will receive a separate 1099-SA for each type of distribution made during the year.

If you currently live in the United States and you need a replacement form SSA-1099 or SSA-1042S we have a new way for you to get an instant replacement quickly and easily beginning February 1st by. Youll be able to access your form and save a printable copy. Updated on March 17 2021 - 1030 AM by Admin TaxBandits.

Go to Sign In or Create an Account. Get a copy of your Social Security 1099 SSA-1099 tax form online. Using your online my Social Security account.

Health savings account HSA. You can find IRS Form 8889 on the IRS website or log in to your account under Statements Docs section. IRS Form 1099-SA provides you with the distributions made from your HSA during the tax year.

1099Gs are available to view and print online through our Individual Online Services. Select Jump To 1099-SA. Where to Get Form 1099-SA.

Download Form 4852 Substitute for Form W-2 Wage and tax Statement or Form 1099-R Distribution from Pensions Annuities Retirement or Profit-sharing Plans IRAs Obtain phone assistance through 800-829-1040. If you live in the United States and you need a replacement form SSA-1099 or SSA-1042S simply go online and request an instant printable replacement form through your personal my Social Security account. Both the IRS Form 1099-SA and IRS Form 5498-SA will be available online the end of January.

Need a replacement copy of your SSA-1099 or SSA-1042S also known as a Benefit Statement. To 7 pm Monday-Friday your local time - except Alaska and Hawaii which are Pacific time. A Form 1099-SA will be sent by January 31 2020 if you received any distributions from your HSA account during 2019.

A Form 5498-SA will be sent in May 2020 which will report contributions to your HSA account for 2019 and the fair market value of your HSA account as of 12-31-2019. Click on My Info from the menu on the left-hand side. The five distribution types are normal excess contribution removal death disability and prohibited transaction.

When you will receive your forms. All you need to know about Form 941 Worksheet 1 2021 2020. Medicare Advantage Medical Savings Account MA MSA.

Form 1099-INT 1099-R and 1099-SA statements will be available online for immediate download on Online Banking by the end of January. A separate return must be filed for each plan type. These IRS tax forms are also available in the Member Website.

All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. IRS Form 1099-SA is provided for each HSA distribution you made in the current tax year. Archer Medical Savings Account Archer MSA.

The IRS released the draft version of Form 941 in April with the COVID-19 related changes and the final version was released in. You can get copies of your most recent tax forms by signing in to your account online and viewing the Statements and Docs section. If you did not receive your SSA-1099 or have misplaced it you can get a replacement online if you have a My Social Security account.

IRS Form 8889 can be downloaded at any time. Ready to say goodbye to printed forms. Please note some tax statements are not currently available online.

Inside your program search for 1099-SA. Health Savings Account HSA You will receive the IRS Form 1099-SA and IRS Form 5498-SA either by mail or electronically based upon your elected delivery preference.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

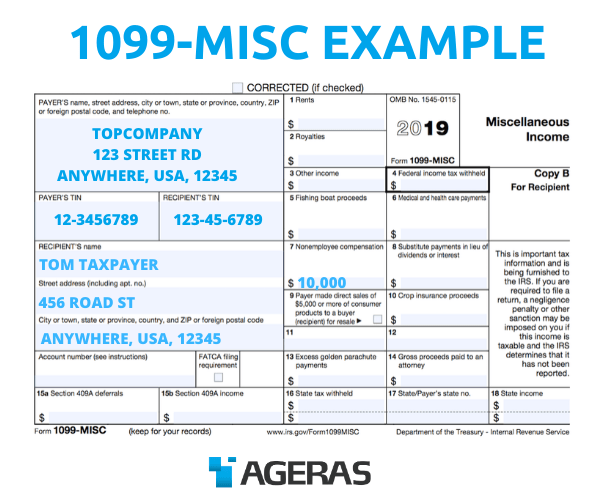

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Tax Form 1099 How It Works And Who Gets One Ageras

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

All You Need To Know About The 1099 Form 2020 2021

All You Need To Know About The 1099 Form 2020 2021

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

5498 Ira Esa Sa Contribution Information 1099r

5498 Ira Esa Sa Contribution Information 1099r

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return