Will Turbotax Deluxe Do 1099 Misc

Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022. 1099-DIV Dividend Income.

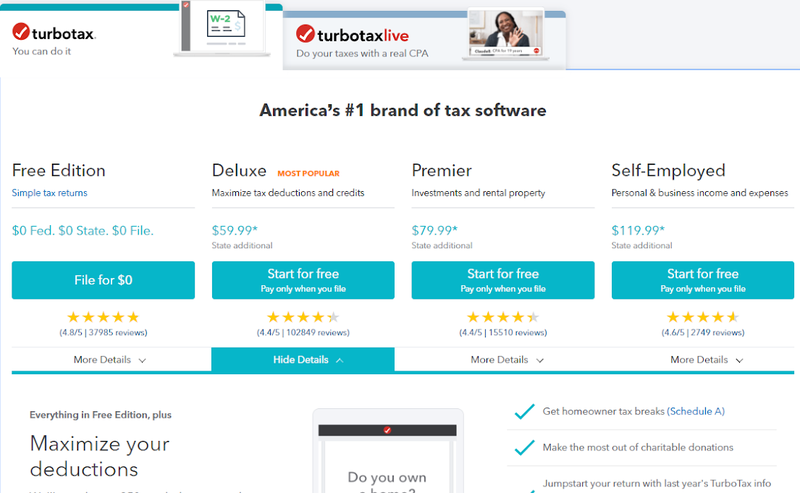

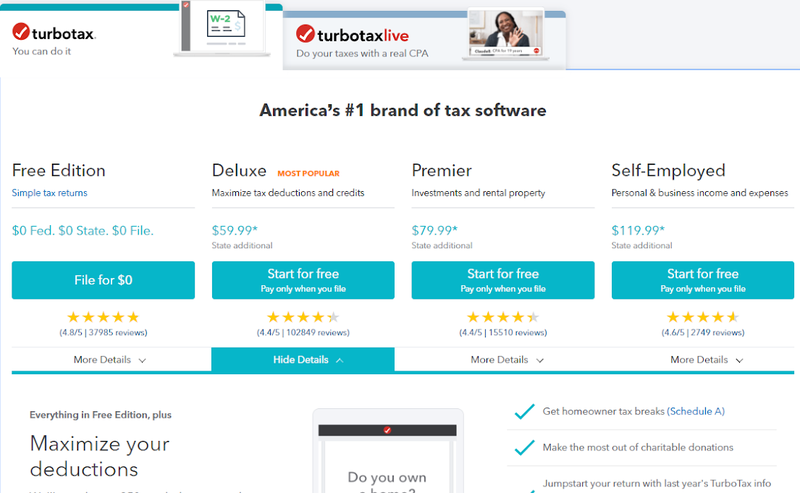

Which Turbotax Version Should I Use In 2021

Which Turbotax Version Should I Use In 2021

Open or continue your return if youre not already in it.

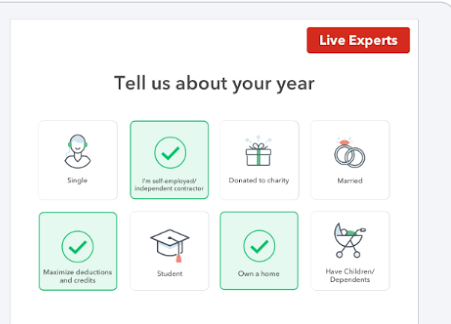

Will turbotax deluxe do 1099 misc. I disagree with the standard advice given by Turbotax. He is NOT self-employed by any stretch of the imagination. If you are issued a 1099-misc and youre a freelancer you are considered to have your own business and a schedule C has to be produced which is why TurboTax is including this as business income which is what it is.

If you are self-employed a freelancer contractor or work a side gig you may be used to receiving Form 1099-MISC that reports your self-employed income at tax time. Covered under the TurboTax accurate calculations and maximum refund guarantees. Terms and conditions may vary and are subject to change without notice.

To enter a 1099-MISC for miscellaneous income in TurboTax. If you only have a W-2 from work and various Form 1099s you may only need the TurboTax Free Edition. Beginning in 2020 the 1099-MISC has been replaced by the 1099-NEC for non-employee compensation.

If you earn income that isnt from employment you may be receiving a 1099-MISC in the mail before your tax return is due on May 17 2021. February 4 2021 TurboTaxKat English. My husband an employee received a 1099-MISC from a company that sponsored a workshop he attended at the request of his employer and which had reimbursed him for his travel expenses.

You need TurboTax Premier or higher to complete the forms related to investments This implies to me that TurboTax Deluxe HAS the data but wont let you USE it. Español de Estados Unidos. 1099-G Certain Government Payments.

Videos you watch may be added to the TVs watch history and influence TV recommendations. Available in mobile app only. Beginning with tax year 2020 the IRS will require your self-employment income of 600 or more to be reported on Form 1099-NEC non-employee compensation instead of Form 1099-MISC.

What versions of TurboTax do I need to file. Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021. When you are completing your tax return and it is time to enter 1099 information you can use the TurboTax import feature.

TurboTax Deluxe is our most popular product among TurboTax Online users with more complex tax situations. Yes all versions of TurboTax can import 1099 data from your financial institution. 1099-NEC Snap and Autofill.

Note however that investments such as stocks or bonds are reported on 1099-B. I had Deluxe and am trying the Self-Employed version but that seems much more than I need as I dont own any. You will not be able to import it sooner.

I was paid as a hairstylist 1099 Lyft driver no 1099 - did not make enough and W-2 employee. Search for 1099-misc and select the Jump-to link. 1099-MISC Miscellaneous Income.

This was done to help clarify the separate filing deadlines on Form 1099-MISC and the new 1099-NEC form will be used starting with the 2020 tax year. A Form 1099-MISC can only be created using the TurboTax Self-Employed online editions or the TurboTax desktop Home Business edition for Windows or the Business Edition. These questions can help you figure out which version you need.

1099-NEC Snap and Autofill. Hello Im Jill from TurboTax with important news for taxpayers who received a 1099-MISC form this year. Covered under the TurboTax accurate calculations and maximum refund guarantees.

When your 1099 is available in your Stockpile account you will be able to import it directly into TurboTax. Answer Yes to Did you get a 1099-MISC. If you already entered a 1099-MISC youll be on the 1099-MISC Summary screen in which case select Add Another 1099-MISC.

If playback doesnt begin shortly try restarting your device. The Form 1099s the Basic version supports are. Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021.

Available in mobile app only. TurboTax Deluxe is our most popular product among TurboTax Online users with more complex tax situations. The IRS has reintroduced Form 1099-NEC as the new way to report self-employment income instead of Form 1099-MISC as traditionally had been used.

1099-INT Interest Income.

1099 Nec Schedule C Won T Fill In Turbotax

1099 Nec Schedule C Won T Fill In Turbotax

5 Best Things You Can Do With A Tax Refund The Finance Twins Tax Refund Tax Money Finance

5 Best Things You Can Do With A Tax Refund The Finance Twins Tax Refund Tax Money Finance

Turbotax Makes Filing Almost Fun Inside Design Blog Turbotax Tech Startups Marketing Data

Turbotax Makes Filing Almost Fun Inside Design Blog Turbotax Tech Startups Marketing Data

Https Turbotax Intuit Com Sole Proprietor Investing Home Business

Https Turbotax Intuit Com Sole Proprietor Investing Home Business

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

Re 1099 Misc Assuming Business Ownership

Re 1099 Misc Assuming Business Ownership

Turbotax Free Truth In Advertising

Turbotax Free Truth In Advertising

Exclusively With Turbotax Get An Additional Bonus On Your Federal Tax Refund The Turbotax Blog

Turbotax File Tax Return Max Refund Guaranteed Apps On Google Play

Re How Do I Upgrade To Turbotax For Small Busines

Re How Do I Upgrade To Turbotax For Small Busines

Turbotax Deluxe State 2020 Download 028287563162 38 99 Softwarediscountusa Com Your Premier Source For Discounted Software

Turbotax Deluxe State 2020 Download 028287563162 38 99 Softwarediscountusa Com Your Premier Source For Discounted Software

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

Turbotax Review 2021 Tax Filing Service Price Plans

Turbotax Review 2021 Tax Filing Service Price Plans

Turbotax Makes It Easier For Coinbase Customers To Report Their Cryptocurrency Transactions The Turbotax Blog

Turbotax Makes It Easier For Coinbase Customers To Report Their Cryptocurrency Transactions The Turbotax Blog

How Do I Clear And Start Over In Turbotax Online Turbotax Support Video Youtube

How Do I Clear And Start Over In Turbotax Online Turbotax Support Video Youtube