Wisconsin Sales Tax Business Registration

Virtually every type of business must obtain a State Sales Tax Number. You will receive it within 7-10 business days via US.

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

The departments Business Tax Online Registration system requires a FEIN for most entities that are applying for a permitcertificate.

Wisconsin sales tax business registration. Your business entity type is a. You can do that by registering for Wisconsin business tax. Register with Department of Revenue if any of the following apply.

If you look at the Form BTR-101 you will notice that you are required to provide a reason for application select the type of tax permits that apply to your business business details such as location and type as well as the operations starting date and business owners. Applicable Laws and Rules. Form ST-12 - Sales and Use Tax Return.

Form BTR-101 - Application for Business Tax Registration. The initial registration fee of 20 for new businesses was implemented on January 1 1996. For additional information see our Business Tax Registration Common Questions.

General Information on State Sales Tax. Wisconsin considers it unlawful to collect sales tax in their name without a permit. New Employer Registration - New Employer Registration An online application for employers or their representatives to register a Wisconsin employer.

Wisconsin state income tax and Wisconsin state sales tax. Your other option is to fill out the BTR-101 the Application for Wisconsin Business Tax Registration. You already hold one or more other permits with the Department of Revenue.

Code Sales and Use tax security deposits. Wisconsin Business Tax Registration You will first need to obtain a Wisconsin tax ID number to pay taxes to the Department of Revenue. If your business sells products on the internet such as eBay or through a storefront and the item is shipped within the same state sales tax must be collected from the buyer and the sales tax must be paid on the collected tax to the state.

See Publication 201 Wisconsin Sales and Use Tax for more information. The renewal fee of 10 was implemented January 1 1998. After you do send it to.

You do not need a Wisconsin withholding account number if you. Non-Wisconsin LLC or corporation. You will be automatically redirected to the home page or you may click below to return immediately.

To register for a sales tax permit in Wisconsin you have two options. There are two main types of tax that you will pay to the Wisconsin Department of Revenue. Skip to Main Content.

However some services like those which have to do with manufacturing or creating products are generally considered taxable. State of Wisconsin Department of Revenue. You already registered directly with the Department of Financial Institutions DFI You need to register for a motor fuel permit.

To apply for a FEIN contact the IRS at 800 829-1040 or irsgov. Wisconsin State Sales Tax. The fee for the business tax registration is 20.

TeleFile Worksheet and Payment Voucher. The state of Wisconsin does not usually collect sales taxes on the vast majority of services performed. Issuance of the Sellers Permit After receiving the Application for Business Tax Registration and the security deposit if requested a sellers permit will be issued to you by the department.

A Wisconsin Business Registration can only be obtained through an authorized government agency. The best option is to do it online at the Wisconsin Business Tax Registration website. This will include all online businesses.

Go here for more on how to register for a sales tax permit in Wisconsin. Wisconsin asks that you register for a sales tax permit three weeks before your business opens. The initial and renewal fees are used to fund expenditures related to the creation and maintenance of the registration records of.

Registering a business for Wisconsin Unemployment Insurance. Form S-211 - Sales and Use Tax Exemption Certificate. Wisconsin Sales Tax Application Registration Any business that sells goods or taxable services within the state of Wisconsin to customers located in Wisconsin is required to collect sales tax from that buyer.

Click Here to Return to MTA. Your session has expired. Withholding Tax Number Every employer who is required to withhold Wisconsin income taxes must register with the Wisconsin Department of Revenue and obtain a Wisconsin withholding tax number.

50 rows OSB creates an easy step-through process where Wisconsins businesses can find the. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Wisconsin Business Registration.

Businesses Wisconsin Department Of Revenue

Businesses Wisconsin Department Of Revenue

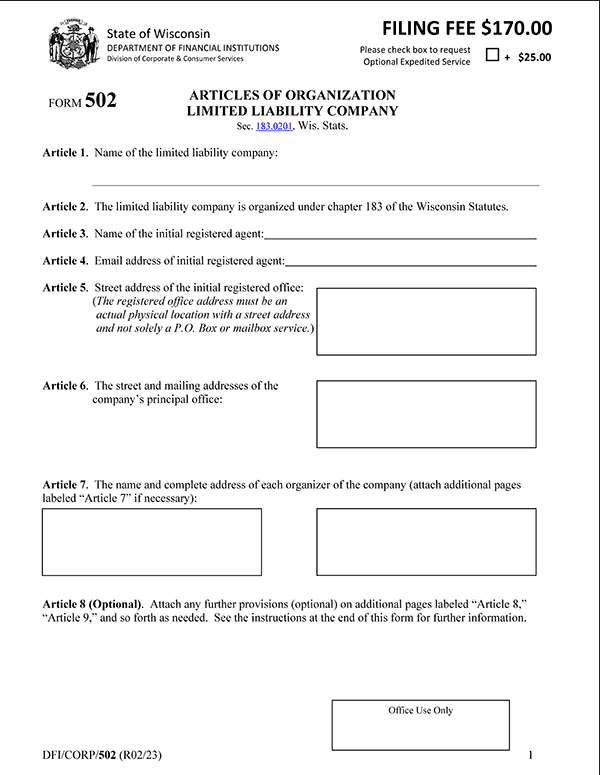

Wisconsin Llc Articles Of Organization Pdf Download Startingyourbusiness Com

Wisconsin Llc Articles Of Organization Pdf Download Startingyourbusiness Com

Wisconsin Car Registration Everything You Need To Know

Wisconsin Car Registration Everything You Need To Know

Register For Sales Use Tax Permits In Every State Harbor Compliance

Register For Sales Use Tax Permits In Every State Harbor Compliance

How To Get A Sales Tax Exemption Certificate In Wisconsin Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Wisconsin Startingyourbusiness Com

Dor Police And Fire Protection Fee Pfpf Registration Information

Dor Police And Fire Protection Fee Pfpf Registration Information

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

How To Search Available Business Names In Wisconsin Startingyourbusiness Com

How To Search Available Business Names In Wisconsin Startingyourbusiness Com

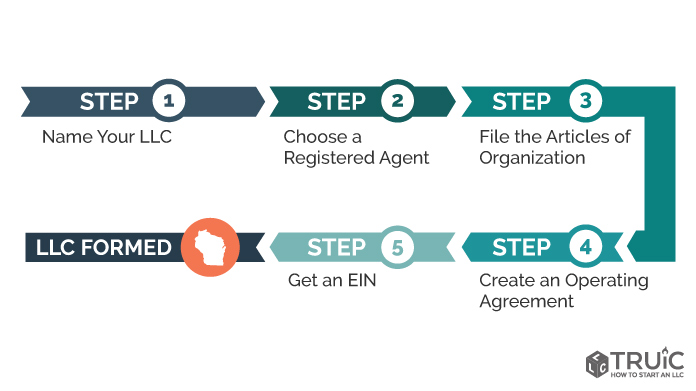

Wisconsin Llc How To Form An Llc In Wisconsin Truic Guides

Wisconsin Llc How To Start An Llc In Wisconsin Nolo

Wisconsin Llc How To Start An Llc In Wisconsin Nolo

Wisconsin Llc How To Form An Llc In Wisconsin Truic Guides

Wisconsin Llc How To Form An Llc In Wisconsin Truic Guides

How To Form An Llc In Wisconsin Startingyourbusiness Com

How To Form An Llc In Wisconsin Startingyourbusiness Com

Https Www Revenue Wi Gov Dorforms Ab 123 Pdf

How To Form An Llc In Wisconsin Startingyourbusiness Com

How To Form An Llc In Wisconsin Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Wisconsin Llc How To Form An Llc In Wisconsin Truic Guides

Wisconsin Llc How To Form An Llc In Wisconsin Truic Guides