What Is Form 8995 And 8995-a

Forms 8995 and 8995-A are used to calculate the QBID. Form 8995-A Schedule A Specified Service Trades or Businesses 2020 01262021 Form 8995-A Schedule B Aggregation of Business Operations 2020 01262021 Form 8995-A Schedule C Loss Netting And Carryforward 2020 01262021 Form 8995-A Schedule D.

Https Www Irs Gov Pub Irs Prior F8995ad 2020 Pdf

First it was Feb 5 then Feb 12 now its Feb 20th.

What is form 8995 and 8995-a. I got a client who is ready to file except for the 8995-A not being ready. The individual has qualified business income QBI qualified REIT dividends or qualified PTP income or loss. That have QBI use Form 8995 to figure the QBI deduction if.

Use separate Schedules A B C andor D as appropriate to help calculate the deduction. The latter Form 8995A is six pages and includes four parts and four schedules that walk practitioners through aggregation of business operations Schedule B and Part 1 loss netting and carryforward Schedule C determining your QBI deduction Part IV calculating the phase-in reduction Part III and other calculations. Form 14039 Identity Theft Affidavit.

Fortunately the deduction is figured for you if you use a paid tax return. You must complete Schedule D Form 8995-A if youre a patron in a specified agricultural or horticultural cooperative and are claiming a QBI deduction in relation to your trade or business conducted with the cooperative. Unless you have entered some type of business rental property or a Schedule K-1 on your tax return there is no reason for a Form 8995 to be included in your tax return.

For the 2019 tax year Form 8995 or 8995-A will be required to be attached to the taxpayers return and submitted to the IRS. If you want to get a better understanding of this important deduction you can review IRS FAQs as well as instructions to. I know that it goes on Form 8995-A line 38.

Form 8995-A is final by the IRS. Taxable income before QBID is less than or equal to certain thresholds. Draft 2019 Form 8995-A Qualified Business Income Deduction IRS has released two draft forms which are to be used to compute the qualified business income deduction under Code Sec.

I have a client with DPAD passed through to them on 1099-PATR. However beginning in 2019 this deduction is calculated on two tax forms. Click on Tax Tools on.

Since this client gets a 5700 REFUND I am. About Form 8995-A Qualified Business Income Deduction About Form 8995-A Qualified Business Income Deduction Use this form to figure your qualified business income deduction. Form SS-4 Application for Employer Identification Number.

I am having a hard time. The draft forms are Form 8995 Qualified Business Income Deduction Simplified Computation and Form 8995-A Qualified Business Income Deduction. Intuit just has not given it priority and keeps pushing the date back.

Form 8995 is the simplified form and is used if all of the following are true. He has the following trades or businesses showing ordinary income and loss as follows. Form 8995-A is the long form for those taxpayers not eligible for short Form 8995.

Form 8995-A - Qualified Business Income Deduction. Form 8995 Qualified Business Income Deduction Simplified Computation. The IRS Form 8995 is a form used by taxpayers to report transactions in a qualified retirement plan annuity or modified endowment contract.

Its required to be filed when a taxpayer participated in a retirement plan and has made a withdrawal from it or has made a contribution to it. Schedule D Form 8995-ASpecial Rules for Patrons of Agricultural or Horticultural Cooperatives. The actual calculation of the deduction was done in 2018 on one of two worksheets depending on the taxpayers income.

Otherwise use Form 8995-A Qualified Business Income Deduction to figure your QBI deduction Say Thanks by clicking the thumb icon in. However should the rest of the QBI information then all be on the 8995-A. Right now ATX is putting the.

Use Form 8995 or 8995-A If you are claiming the QBI deduction for 2020 you will need to fill out either Form 8995 Qualified Business Income Deduction Simplified Computation or Form 8995-A Qualified Business Income Deduction. Form 8995 - Qualified Business Income Deduction Simplified Computation or. Form 8995-A Qualified Business Income Deduction.

You arent a patron in a specified agricultural or horticultural cooperative. Form 9465 Installment Agreement Request. A single taxpayers taxable income before the QBI deduction is more than 160700 thus he is required to use the Form 8995-A instead of Form 8995 to calculate his QBI.

Use Form 8995 if your taxable income is less than the income threshold in the table above. Form 8995-A Qualified Business Income Deduction.

Irs Draft Form 8995 Instructions Include Helpful Qbi Flowchart Center For Agricultural Law And Taxation

Irs Draft Form 8995 Instructions Include Helpful Qbi Flowchart Center For Agricultural Law And Taxation

Staying On Top Of Changes To The 20 Qbi Deduction 199a One Year Later Wffa Cpas

Staying On Top Of Changes To The 20 Qbi Deduction 199a One Year Later Wffa Cpas

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

Https Www Guidestone Org Media Guidestone Corporate Ministry Tools Mintaxguide 2112 Mintaxguidesec4 Pdf La En

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Where Does Dpad Go Cla Cliftonlarsonallen

Where Does Dpad Go Cla Cliftonlarsonallen

Instructions For Form 8995 A 2020 Internal Revenue Service

Instructions For Form 8995 A 2020 Internal Revenue Service

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

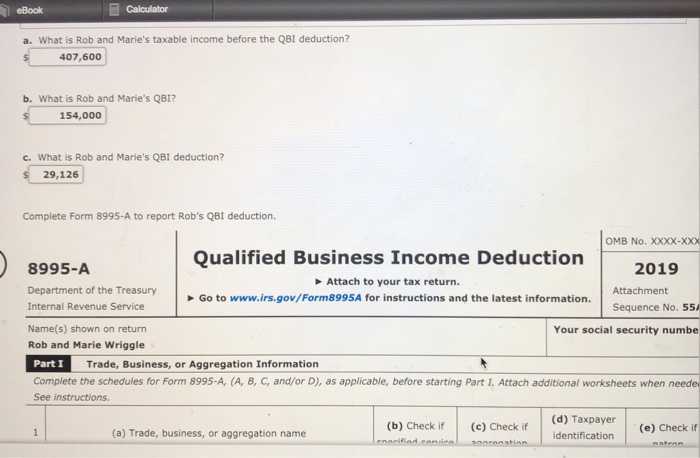

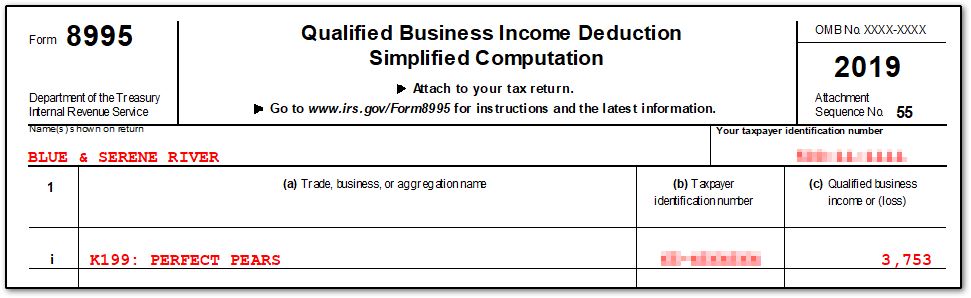

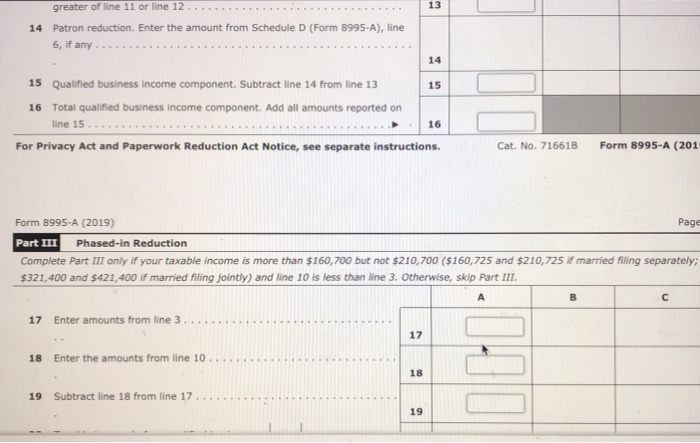

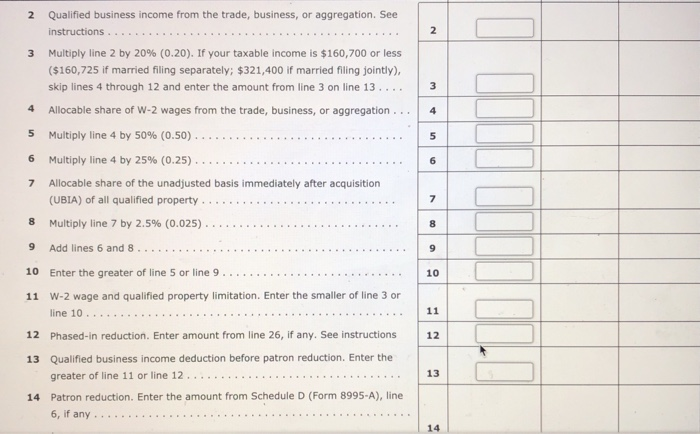

Solved I Need Help Completing The Form 8995 A For This Pr Chegg Com

Solved I Need Help Completing The Form 8995 A For This Pr Chegg Com

Instructions For Form 8995 A 2020 Internal Revenue Service

Instructions For Form 8995 A 2020 Internal Revenue Service

199a For Cooperative Patrons Generating Many Questions Center For Agricultural Law And Taxation

199a For Cooperative Patrons Generating Many Questions Center For Agricultural Law And Taxation

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Solved I Need Help Completing The Form 8995 A For This Pr Chegg Com

Solved I Need Help Completing The Form 8995 A For This Pr Chegg Com

Irs Draft Form 8995 Instructions Include Helpful Qbi Flowchart Center For Agricultural Law And Taxation

Irs Draft Form 8995 Instructions Include Helpful Qbi Flowchart Center For Agricultural Law And Taxation

Solved I Need Help Completing The Form 8995 A For This Pr Chegg Com

Solved I Need Help Completing The Form 8995 A For This Pr Chegg Com

Instructions For Form 8995 A 2020 Internal Revenue Service

Instructions For Form 8995 A 2020 Internal Revenue Service