Square Tax Reporting And Form 1099-k

Frequently asked questions FAQs. Square is required to issue a Form 1099-K and report to the state when 600 or more is processed in card payments.

What Is A 1099 Form Everything You Need To Know About This Tax Document Student Loan Hero

To update your Form 1099-K for a previous year please begin by updating your taxpayer information from your online Square Dashboard to ensure that your Square business name matches what the IRS has on file.

Square tax reporting and form 1099-k. The District of Columbia Virginia Maryland Massachusetts or Vermont and 600 or more is processed in card payments. As such the income for sole-proprietors is reported on their Schedule C as gross receipts subject to the self-employment tax. You can complete these copies online for furnishing statements to recipients and for retaining in your own files.

However the designation does not relieve the facilitator from liability for any applicable penalties under sections 6721 and 6722 for failure to comply with the information reporting requirements. Square will provide a 1099-K form for you if meet both of the following criteria. What is a 1099-K form.

Illinois and more than 1000 in processed card payments and more than 3 processed transactions. Summaries and Reports from the Online Square Dashboard. Form 1099-K Tax Reporting Information.

Update Your Taxpayer Identification Number. For FAQs about Form 1099-K reporting go to IRSgovpaymentsgeneral-. In order to update your taxpayer information make sure to have a copy of an official bank statement on your banks letterhead which shows transfers from Square to your business.

Square Tax Reporting and Form 1099-K Overview. Reporting a 1099-K on your tax return Beginning with the 2012 tax year if you are self-employed report your 1099-K payments on Schedule C on a separate revenue line. The new requirement is in Section 9674 of the federal bill and dramatically lowers the annual 1099-K reporting threshold from 20000 and 200 transactions to just 600 and eliminates the.

If you have multiple accounts that use the same TIN we will aggregate the volume for all accounts to see if you qualify for a Form 1099-K. These reporting thresholds are based on the aggregate gross sales volume processed on all accounts using the same Tax Identification Number TIN. Partnerships and corporations would report those amounts in a similar manner on their returns.

Square is required to issue a Form 1099-K and report to the state if your taxpayer information is associated with. Square Tax Reporting and Form 1099-K Overview. Summaries and Reports from the Online Square Dashboard.

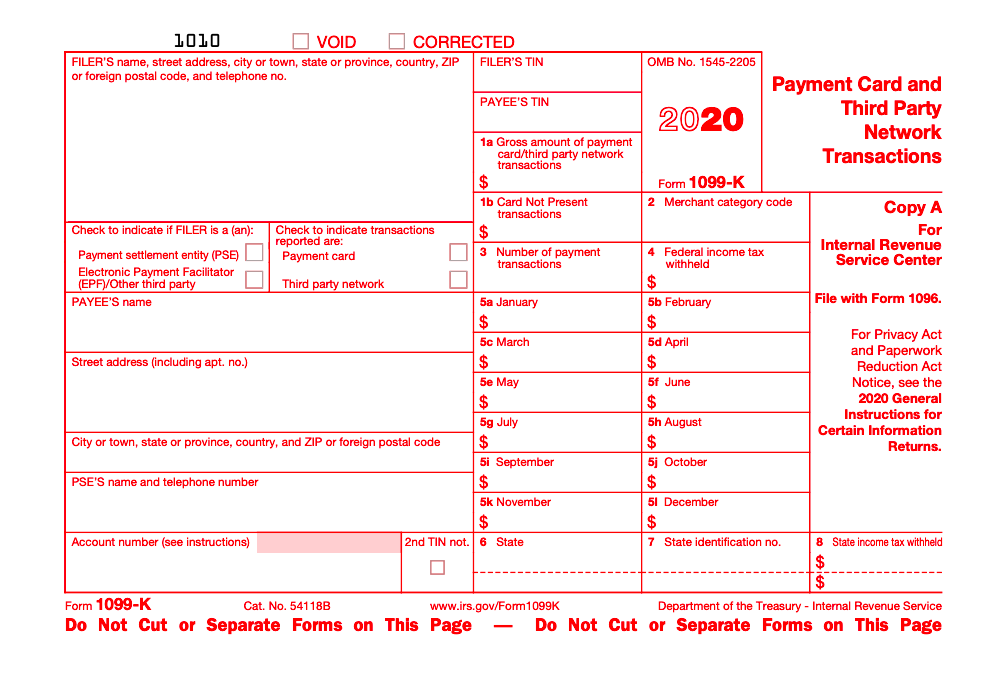

A 1099-K form is the information return that is given to the IRS and qualifying customers. Furnishing requirements Copies 1 B 2 and C of Form 1099-K are fillable online in a PDF format available at IRSgovForm1099K. Square is required to issue a Form 1099-K and report to the state when 600 or more is processed in card payments.

The PSE can file Form 1099-K by designation if the parties agree in writing. Consider performing a double check on your total business income by comparing the total revenue on Schedule C to your profit and loss statement from your accounting system. Square Tax Reporting and Form 1099-K Overview.

Form 1099-K Tax Reporting Information. These reporting thresholds are based on the aggregate gross sales volume processed on all accounts using the same Tax Identification Number TIN. The IRS requires Payment Settlement Entities such as Square to report the payment volume received by US.

Summaries and Reports from the Online Square Dashboard. Tax Reporting Topics. Do I qualify for a 1099-K form.

Form 1099-K Tax Reporting Information. Taxation of Amounts from Form 1099-K Most individuals Form 1099-K reports payments to their trade or business.

Form 1099 K And Ecommerce Merchant Fees Bench Accounting

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

What To Do With Form 1099 Misc

All About Forms 1099 Misc And 1099 K Brightwater Accounting

Tax Forms In Vagaro 1099s For Taxes Vagaro Support

Form 1099 K Everything You Need To Know Bench Accounting

Irs Form 1099 K What Your Online Business Needs To Know Audits

1099 Misc Software 289 Efile 449 Outsource 1099 Misc Software

Form 1099 K Everything You Need To Know Bench Accounting

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Irs Forms 1099 Are Coming Key Facts For Your Taxes

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions Taxgirl

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Solved Your First Tax Season With Square The Seller Community

Solved Everything You Need To Know About 1099 K Tax Forms Page 2 The Seller Community